Andre Chappel, Arpit Misra, Steven Sheingold

Disclaimer: Persons with disabilities having problems accessing this document may call (202) 690-6870 for assistance.

"Executive Summary

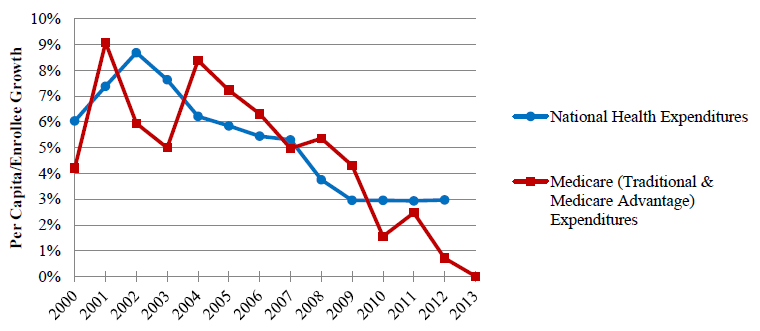

The rate of national health care spending growth per person has been on a downward trajectory in recent years (see Figure 1). This downward trend has been especially significant for the Medicare program since 2009. In fact, the most recent data show that the average per enrollee annual spending growth rate for the Medicare program (including both Traditional Medicare and the Medicare Advantage (MA) program) for 2009-2012 was one-third of the average growth rate from 2000-2008: 2.3 percent versus 6.3 percent (data not shown in table).1 The preliminary estimate of the per enrollee expenditure growth rate for Medicare in 2013 is only 0.1 percent. In other words, there was essentially no growth in Medicare expenditures on a per capita basis last year. The number of beneficiaries covered by the program is rising by about 3 percent per year, and the aggregate (across all beneficiaries) estimated Medicare expenditure growth rate for 2013 is 3 percent.2 Early claims data as well as Treasury data on Medicare payments from the first half of 2014 indicate that very slow per capita growth has continued so far this year, although final spending growth estimates will not be available for some time.3

Figure 1

Per Capita/Enrollee Spending Growth Rates for National Health Expenditures and Medicare, 2000-2012

Data Source: 2000-2012 data from CMS National Health Expenditure Accounts, preliminary 2013 Medicare per enrollee spending growth rate estimate from Centers for Medicare and Medicaid Services Office of the Actuary.

Note: Growth rate for 2006 only includes Parts A and B to avoid artificially high growth from introduction of the Part D program.

Due to the recent slowdown in spending growth, the Medicare Board of Trustees and the Congressional Budget Office (CBO) have both lowered their projections of Medicare spending in future years.4 In the 2014 Medicare Trustees Report, released on July 28, OACT projects that the solvency of the Hospital Insurance (HI) Trust Fund will be extended an additional 4 years beyond last year’s projection from 2026 to 2030.

The improved outlook in the Trustees Report is due, in part, to:

- Lower-than-expected spending in 2013 for most HI-related service categories, especially for inpatient hospital care

- Lower projected utilization assumptions for inpatient hospital services; and

- Lower case mix increase assumptions for skilled nursing facilities and home health agencies, indicating patients in these settings are healthier than expected.

Medicare spending growth for other services and items is also low for a variety of reasons.5

The Congressional Budget Office also recently extended its projection of the HI Trust Fund’s solvency to roughly 2030.6

This issue brief provides additional analyses of recent trends in per enrollee spending in the traditional Medicare program. Specifically, we examine spending trends for detailed service categories and for geographic areas. Key findings include:

- The average annual per enrollee spending growth rate for the Medicare program for 2009-2012 was 2.3 percent – this number represents a decline of 4.0 percentage points from the 2000-2008 average annual rate of 6.3 percent. In other words, this growth rate is about one-third as high as it was previously. Moreover, the estimated per enrollee expenditure growth rate for Medicare in 2013 is only 0.1 percent. The aggregate estimated Medicare expenditure growth rate for 2013 is 3 percent, reflecting an annual rise in the number of new beneficiaries of approximately 3 percent.7

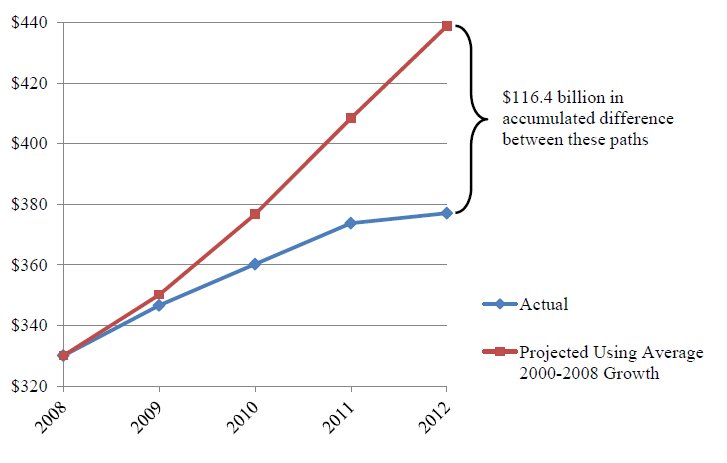

- Medicare spending between 2009 and 2012 for beneficiaries in the traditional program (i.e., not including those enrolled in MA) was approximately $116.4 billion lower than what it would have been if the average growth rate for 2000-2008 had continued through 2012.

- The slowdown in the rate of growth in health spending has important implications for both beneficiaries and taxpayers. Current law establishes the standard Part B premium at the level of approximately 25 percent of average expenditures for beneficiaries who are age 65 and over (the rate varies for those enrolling after their initial enrollment period ends, those with higher incomes, and those subject to the hold-harmless provision).8 Hence, slow growth in program spending on Part B services in recent years has contributed to a lower premium growth, benefitting beneficiaries. Slow growth in expenditures on pharmaceuticals also leads to lower Part D premiums, which are set by private plans, in part, according to those costs. Furthermore, lower utilization rates benefit beneficiaries by lowering their payments for cost sharing and potentially reflect better quality care with less duplication of services.

- These lower rates of spending growth are projected to continue into future years with important implications for the solvency of the HI Trust Fund: The 2014 Medicare Trustees report and the CBO estimate that the Trust Fund will be depleted in 2030, four years later than projected by the Trustees last year.

- The slowdown in Medicare spending growth that occurred between the periods of 2000-2008 and 2009-2012 was widespread across service categories. In most service categories, the slowdown in expenditure growth was primarily attributable to reductions in utilization.

- Regional patterns of spending for home health services and durable medical equipment suggest that Medicare’s payment policy changes, program integrity efforts, and competitive bidding policies played a role in the slowdown.

- Reductions in spending growth for acute inpatient and post-acute care services accounted for half of the overall slowdown in spending growth. Post-acute care accounted for a disproportionately large proportion of the overall reduction in spending growth relative to its share of overall spending.

- Slowdowns in drug and imaging utilization suggest that a shift to generics, as well as slower development and utilization of medical technology was a factor.

- The ongoing shift from inpatient to outpatient settings for surgical care, as well as, the shifting age distribution of the Medicare population toward younger new entrants has had implications for spending growth in both the inpatient and post-acute care settings.

1 Growth percentages for total Medicare spending calculated from Centers for Medicare and Medicaid Services National Health Expenditure Accounts. Growth rate for 2006, used to calculate average growth rate for 2000-2008, only includes Parts A and B to avoid artificially high growth from introduction of the Part D program.

2 Personal communication, Centers for Medicare and Medicaid Services Office of the Actuary, estimated per capita spending growth for calendar year 2013.

3 ASPE analysis of current Q1 2014 Medicare claims data; Monthly Treasury Statements of Receipts and Outlays of the United States Government; Monthly Budget Review for June 2014 (Washington, D.C.: Congressional Budget Office, July 8, 2014).

4Medicare - April 2014 Baseline (Washington, D.C.: Congressional Budget Office); Medicare - August 2010 Baseline (Washington, D.C.: Congressional Budget Office, August 2010); Office of the Actuary, National Health Expenditure Projections 2012-2022 (Baltimore, MD: Centers for Medicare & Medicaid Services, 2013); Office of the Actuary, National Health Expenditure Projections 2008-2018 (Baltimore, MD: Centers for Medicare and Medicaid Services, 2009).

5 Board of Trustees, 2014 Annual Report of the Boards of Trustees of the Federal Hospital Insurance and Federal Supplementary Medicare Insurance Trust Funds (Washington, D.C.: Centers for Medicare & Medicaid Services, 28 July 2014).

6The 2014 Long-Term Budget Outlook (Washington, D.C.: Congressional Budget Office, July 2014); The 2013 Long-Term Budget Outlook (Washington, D.C.: Congressional Budget Office, September 2013).

7 CMS Office of the Actuary estimated per capita spending growth for calendar year 2013.

8 Board of Trustees.

I. National Health Spending

There is considerable uncertainty regarding the relative contribution of various factors to the slowdown in national healthcare spending. Factors likely to have affected spending growth in recent years include:

- Slower growth in the demand for health care services due to the recession and modest recovery

- Changes in care delivery related to pre-Affordable Care Act (ACA) and ACA related payment changes and value-based purchasing efforts

- The recent high rates of generic penetration in the prescription drug market accompanied by lower rates of use of new health care technology; and

- Changes in the benefit design of employer sponsored insurance.

How much of the slowdown in national health spending is due to the recession and its subsequent slow recovery has been a matter of considerable discussion. Recent studies applying different methods have found a substantial range in estimates.9 However, a CBO analysis suggests that, whatever role the recession may have played in driving trends in private health care spending, the recession appears to have played a small role in driving trends in Medicare spending. Their analysis estimated the effect of changes in wealth and income due to the recession on Medicare beneficiaries’ use of health care services and found that the recession had little effect on demand for health care services by Medicare beneficiaries.10 As evidenced by Figure 1 above, the slowdown in per capita spending growth began prior to the recession, suggesting that other factors have been at play. In addition, the CBO and other analysts find that reductions in utilization rather than payment played a significant role suggesting that more fundamental changes in the health care delivery system may account for these trends.11

9Assessing the Effects of the Economy on the Recent Slowdown in Health Spending (Washington, D.C.: The Henry J. Kaiser Family Foundation, 22 April 2013) <http://kff.org/health-costs/issue-brief/assessing-the-effects-of-the-eco... [accessed 8 July 2013]; David M. Cutler and Nikhil R. Sahni, ‘If Slow Rate Of Health Care Spending Growth Persists, Projections May Be Off By $770 Billion’, Health Affairs, 32 (2013), 841–50.

10 Michael Levine and Melinda Buntin, Why Has Growth in Spending for Fee-for-Service Medicare Slowed? (Washington, D.C.: Congressional Budget Office, August 2013).

11 Cutler and Sahni.

II. Quantifying the Impact of the Slowdown in Medicare Spending Growth

Figure 2 displays per enrollee spending for beneficiaries in the traditional Medicare program. The figure includes spending on Part A and B services, as well as on prescription drugs (Part D) in 2009, 2010, 2011, and 2012 (the latest year of data available from the Master Beneficiary Summary File). The figure also displays an illustrative trend line showing what spending would have been if the growth rate during these years had been equal to the average growth rate of per enrollee spending for 2000-2008. Growth attributable to Part D spending was excluded for 2006 because spending growth for the years 2000-2008 would have appeared artificially high due to introduction of the Part D program. The difference between the trend lines implies a substantial reduction in accumulated spending of $116.4 billion relative to what spending would have been if the average growth rate for 2000-2008 had continued through 2012.

Figure 2

Actual vs. Illustrative Growth in Personal Health Expenditures for the Traditional Medicare Program Using 2000-2008 Average Expenditure Growth

(in billions)

Data Source: CMS Medicare Beneficiary Summary File

Notes: Projections include spending on Medicare Parts A, B, and D for traditional Medicare beneficiaries.

Growth rate for 2006, used to generated 2000-2008 projection only includes Parts A and B to avoid artificially high growth rate from introduction of the Part D program.

III. Medicare Spending Growth Trends by Service Category

In order to provide a more detailed analysis of the slowdown in Medicare spending, we examined trends in spending by service category and by geographic area. Table 1 compares the compounded average growth rate for the 2000-2008 period and more recent years (2009-2012), by service category. Definitions for each of the service categories used in this analysis are reported in the Appendix (see Table A.1). As with any time period comparisons, the beginning and end years chosen can affect the findings. The earliest year available for the Master Beneficiary Summary File (MBSF, summary data on spending and utilization for beneficiaries in the traditional Medicare program) is 1999, which was used to calculate growth in 2000. The first year of the recession (2008) was selected as the end point for the historical period. The latest year of available MBSF data is 2012. All service categories, with the exception of Anesthesia, experienced declines in their average growth in recent years.

While Table 1indicates the service categories that experienced the largest reductions in spending growth, it does not identify those service categories that contributed the most to the overall slowdown in spending growth. That information is presented in Table 2, which displays each service category’s contribution to the slowdown and its contribution to overall Medicare spending. Post acute services (SNF, home health, hospice), Part B drugs, and imaging procedures contributed the most to the slowdown relative to their share of spending. Although acute inpatient services accounted for 25 percent of the overall slowdown in spending growth, this contribution was smaller than its 32 percent share of overall spending.

Table 1

Change in Medicare Compound Average Spending Growth between 2000-2008 and 2009-2012, by Service Category

| Medicare Service Category | Compound Average Annual Growth | Change in Compound Average Annual Growth | |

|---|---|---|---|

| 2000-2008 | 2009-2012 | ||

| Hospice | 16.3% | 4.7% | -11.6 |

| Imaging | 6.5% | -4.0% | -10.5 |

| Part B Drugs | 11.7% | 1.9% | -9.8 |

| DME | 5.9% | -2.7% | -8.6 |

| Part D | 11.7% | 3.8% | -8.0 |

| SNF | 9.6% | 1.8% | -7.8 |

| Home Health | 7.7% | 0.1% | -7.6 |

| ASC | 9.2% | 2.9% | -6.3 |

| Testing | 7.2% | 3.1% | -4.2 |

| Other Part B | 6.7% | 2.7% | -4.0 |

| Acute Inpatient | 3.1% | -0.4% | -3.5 |

| HOPD | 9.3% | 6.6% | -2.7 |

| Other Inpatient | 4.5% | 2.1% | -2.4 |

| Physician E&M | 5.1% | 3.0% | -2.1 |

| Other Procedures | 4.4% | 2.3% | -2.1 |

| Dialysis | 2.4% | 2.2% | -0.1 |

| Anesthesia | 2.9% | 3.4% | 0.5 |