ASPE ISSUE BRIEF

Health Insurance Marketplace Premiums for 2014

September 2013

Abstract

This report summarizes the health plan choices and premiums that will be available in the Health Insurance Marketplace. It contains new information, current as of September 18, 2013, on qualified health plans in the 36 states in which the Department of Health and Human Services (HHS) will support or fully run the Health Insurance Marketplace in 2014. Plan data is in final stages but is still under review as of September 18 and may be revised in HHS systems before being displayed for consumers, so this information is subject to change. This analysis also includes similar information that is publicly available from 11 states and the District of Columbia that are implementing their own Marketplace. This report focuses on the plans with the lowest premiums in each state, as consumers are expected to shop for low-cost plans. Nearly all consumers (about 95%) will have a choice of 2 or more health insurance issuers (often many more) and nearly all consumers (about 95%) live in states with average premiums below earlier estimates.

On October 1, 2013, a Health Insurance Marketplace will open in each state, providing a new, simplified way to compare individual market health insurance plans. Americans will be able to use the Health Insurance Marketplace to shop for and purchase health insurance coverage, which will begin January 1, 2014. 1 In addition, individuals and families with household incomes between 100 percent and 400 percent of the Federal Poverty Level (FPL) who are not eligible for certain other types of coverage may qualify for tax credits to make premiums more affordable.2

"Summary

This report summarizes the health plan choices and premiums that will be available in the Health Insurance Marketplace. It contains new information, current as of September 18, 2013, on qualified health plans3 in the 36 states in which the Department of Health and Human Services (HHS) will support or fully run the Health Insurance Marketplace in 2014. Plan data is in final stages but is still under review as of September 18 and may be revised in HHS systems before being displayed for consumers, so this information is subject to change. This analysis also includes similar information that is publicly available from 11 states and the District of Columbia that are implementing their own Marketplace.4 This report focuses on the plans with the lowest premiums in each state, as consumers are expected to shop for low-cost plans.

Nearly all consumers (about 95%) will have a choice of 2 or more health insurance issuers (often many more) and nearly all consumers (about 95%) live in states with average premiums below earlier estimates.5 Other key findings include:

Individuals will have an average of 53 qualified health plan choices in states where HHS will fully or partially run the Marketplace6

- Individuals and families will be able to choose from a variety of bronze, silver, gold, and platinum plans in the Health Insurance Marketplace, as well as catastrophic plans for young adults and those without affordable options.7 Health insurance issuers can offer multiple qualified health plans, including multiple qualified health plan choices within a single metal level. In the 36 states in this analysis, the number of qualified health plan choices available in a rating area ranges from a low of 6 to a high of 169 plans.8 On average, individuals and families will have 53 qualified health plans to choose from in their rating area. Young adults will have an average of 57 qualified health plans to choose from, including catastrophic plans. The average number of choices will likely increase after including final data from state-based Marketplaces, which tend to have greater issuer participation.

- On average, there are 8 different health insurance issuers9 participating in each of the 36 Marketplaces included in this analysis. This ranges from a low of 1 issuer to a high of 13 issuers within a state. About 95 percent of the non-elderly population in these 36 states lives in rating areas with 2 or more issuers. Roughly one in four issuers is offering health plans in the individual market for the first time in 2014.10

Premiums before tax credits will be more than 16 percent lower than projected

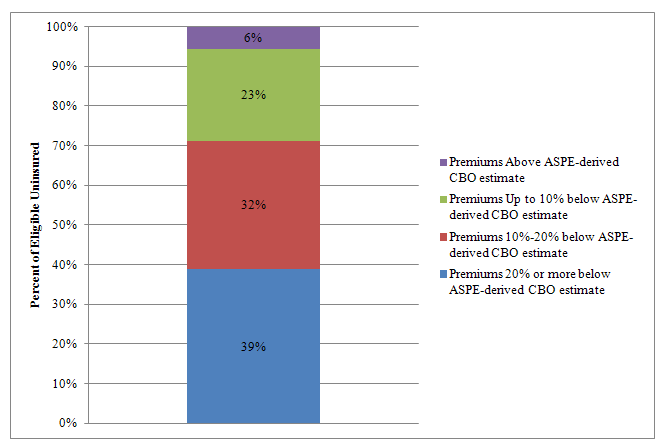

- The weighted average second lowest cost silver plan for 48 states (including DC) is 16 percent below projections based on the ASPE-derived Congressional Budget Office premiums.11 In 15 states, the second lowest cost silver plan will be less than $300 per month – a savings of $1,100 a year per enrollee compared to expectations. Overall, 95% of the uninsured potentially eligible for the Marketplaces live in states with average premiums below ASPE-derived CBO projected premiums (see Figure 1).12

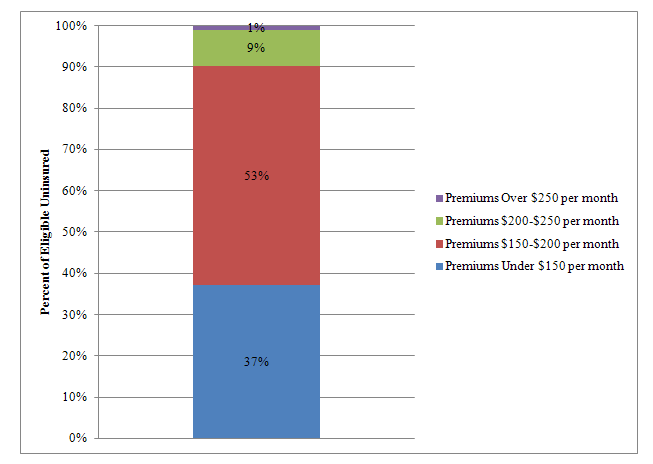

- Young adults will pay lower premiums and also have the option of a catastrophic plan that covers prevention, some primary care, and high costs in cases of major accident or illness.13 The weighted average lowest monthly premiums for a 27-year-old in 36 states14 will be (before tax credits): $129 for a catastrophic plan, $163 for a bronze plan, and $203 for a silver plan. More than half of the uninsured potentially eligible for the Marketplaces live in a state where a 27-year-old can purchase a bronze plan for less than $165 per month before tax credits. There are an estimated 6.4 million uninsured Americans between the ages of 25 and 30 who may be eligible for coverage through Medicaid or the Marketplaces in 2014.15

Premiums after tax credits

- Tax credits will make premiums even more affordable for individuals and families. For example, in Texas, an average 27-year-old with income of $25,000 could pay $145 per month for the second lowest cost silver plan, $133 for the lowest cost silver plan, and $83 for the lowest cost bronze plan after tax credits. 16 For a family of four in Texas with income of $50,000, they could pay $282 per month for the second lowest cost silver plan, $239 for the lowest silver plan, and $57 per month for the lowest bronze plan after tax credits.17

- After taking tax credits into account, fifty-six percent of uninsured Americans (nearly 6 in 10) may qualify for health coverage in the Marketplace for less than $100 per person per month, including Medicaid and CHIP in states expanding Medicaid.18

Premiums tend to be lower in states where there is more competition and transparency

- In the 36 states included in this analysis, states with the lowest average premium tend to have a higher average number of issuers offering qualified health plans. There are, on average, 8 issuers participating in the Marketplace in the states with average premiums in the lowest quartile, compared to an average of 3 issuers in states with average premiums in the highest quartile.

Figure 1: Percent of Uninsured Potentially Eligible for the Marketplaces by Second Lowest Cost Silver Premium Relative to ASPE-Derived CBO Estimate, 48 States

The following figure shows the distribution of uninsured Americans potentially eligible to enroll in the Marketplaces in the 48 states with available premium information, as compared to the ASPE-derived CBO premium estimate of $392 per month.

NOTE: This figure uses weighted average second lowest cost silver premiums as depicted in Table 4, before tax credits.

States are weighted by the number of uninsured potentially eligible for the Marketplaces.

Figure 2: Percent of Uninsured Potentially Eligible for the Marketplaces by Lowest Cost Bronze Premium for a 27 Year Old, 36 States19

The following figure shows the distribution of uninsured Americans potentially eligible to enroll in the Marketplaces by bronze premiums for a 27-year-old.

NOTE: This figure uses weighted average lowest cost bronze premiums for a 27-year-old as depicted in Table 1, before tax credits. States are weighted by the number of uninsured potentially eligible for the Marketplaces.

Table 1: Premiums and Qualified Health Plan Choices, 36 States (Weighted average across entire state)

|

State |

Average Number of QHPs20 |

27-Year-Old, Before Tax Credits |

27-Year-Old with an Income of $25,000 |

Family of Four with an Income of $50,00021 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Lowest Bronze |

Lowest Silver |

Lowest Gold |

Lowest Catastrophic |

Second Lowest Silver Before Tax Credit |

Second Lowest Silver After Tax Credit |

Lowest Bronze After Tax Credit |

Second Lowest Silver Before Tax Credit |

Second Lowest Silver After Tax Credit |

Lowest Bronze After Tax Credit22 |

||

|

Average, 36 States |

53 |

$163 |

$203 |

$240 |

$129 |

$214 |

$145 |

$93 |

$774 |

$282 |

$95 |

|

AK23 |

34 |

$254 |

$312 |

$401 |

$236 |

$312 |

$107 |

$48 |

$1,131 |

$205 |

$0 |

|

AL |

7 |

$162 |

$200 |

$248 |

$138 |

$209 |

$145 |

$98 |

$757 |

$282 |

$112 |

|

AR |

28 |

$181 |

$231 |

$263 |

$135 |

$241 |

$145 |

$85 |

$873 |

$282 |

$64 |

|

AZ |

106 |

$141 |

$164 |

$187 |

$107 |

$166 |

$145 |

$120 |

$600 |

$282 |

$192 |

|

DE |

19 |

$203 |

$234 |

$282 |

$137 |

$237 |

$145 |

$111 |

$859 |

$282 |

$158 |

|

FL |

102 |

$169 |

$200 |

$229 |

$132 |

$218 |

$145 |

$96 |

$789 |

$282 |

$104 |

|

GA |

50 |

$179 |

$208 |

$242 |

$142 |

$221 |

$145 |

$103 |

$800 |

$282 |

$132 |

|

IA |

39 |

$139 |

$175 |

$203 |

$95 |

$189 |

$145 |

$96 |

$683 |

$282 |

$103 |

|

ID |

42 |

$150 |

$182 |

$211 |

$134 |

$188 |

$145 |

$107 |

$680 |

$282 |

$144 |

|

IL |

58 |

$134 |

$180 |

$210 |

$134 |

$188 |

$145 |

$90 |

$682 |

$282 |

$84 |

|

IN |

34 |

$200 |

$258 |

$332 |

$168 |

$265 |

$145 |

$80 |

$961 |

$282 |

$46 |

|

KS |

37 |

$130 |

$171 |

$192 |

$87 |

$171 |

$145 |

$104 |

$619 |

$282 |

$133 |

|

LA |

40 |

$175 |

$235 |

$253 |

$142 |

$249 |

$145 |

$71 |

$902 |

$282 |

$15 |

|

ME |

20 |

$216 |

$255 |

$336 |

$182 |

$265 |

$145 |

$96 |

$961 |

$282 |

$104 |

|

MI |

43 |

$146 |

$178 |

$218 |

$118 |

$202 |

$145 |

$89 |

$731 |

$282 |

$80 |

|

MO |

17 |

$162 |

$211 |

$242 |

$110 |

$220 |

$145 |

$87 |

$798 |

$282 |

$72 |

|

MS |

22 |

$225 |

$265 |

$321 |

N/A |

$295 |

$145 |

$75 |

$1,069 |

$282 |

$28 |

|

MT |

26 |

$165 |

$204 |

$222 |

$149 |

$208 |

$145 |

$102 |

$753 |

$282 |

$126 |

|

NC |

22 |

$186 |

$237 |

$283 |

$123 |

$243 |

$145 |

$88 |

$880 |

$282 |

$74 |

|

ND |

24 |

$185 |

$230 |

$259 |

$142 |

$232 |

$145 |

$98 |

$841 |

$282 |

$111 |

|

NE |

40 |

$159 |

$196 |

$232 |

$122 |

$206 |

$145 |

$98 |

$744 |

$282 |

$113 |

|

NH |

12 |

$186 |

$236 |

$281 |

$157 |

$237 |

$145 |

$94 |

$859 |

$282 |

$96 |

|

NJ |

29 |

$219 |

$253 |

$303 |

$186 |

$260 |

$145 |

$103 |

$943 |

$282 |

$131 |

|

NM |

52 |

$143 |

$181 |

$204 |

$120 |

$186 |

$145 |

$102 |

$672 |

$282 |

$128 |

|

OH |

46 |

$177 |

$200 |

$243 |

$131 |

$212 |

$145 |

$110 |

$768 |

$282 |

$156 |

|

OK |

53 |

$114 |

$169 |

$203 |

$105 |

$175 |

$145 |

$84 |

$634 |

$282 |

$63 |

|

PA |

56 |

$151 |

$170 |

$205 |

$125 |

$187 |

$145 |

$109 |

$675 |

$282 |

$152 |

|

SC |

26 |

$176 |

$219 |

$259 |

$146 |

$223 |

$145 |

$97 |

$809 |

$282 |

$109 |

|

SD |

32 |

$196 |

$225 |

$272 |

$169 |

$235 |

$145 |

$106 |

$852 |

$282 |

$141 |

|

TN |

59 |

$119 |

$155 |

$205 |

N/A |

$161 |

$145 |

$103 |

$584 |

$282 |

$128 |

|

TX |

54 |

$139 |

$189 |

$225 |

$139 |

$201 |

$145 |

$83 |

$727 |

$282 |

$57 |

|

UT |

82 |

$153 |

$183 |

$212 |

$116 |

$203 |

$145 |

$95 |

$656 |

$282 |

$122 |

|

VA |

47 |

$156 |

$213 |

$253 |

$118 |

$221 |

$145 |

$80 |

$799 |

$282 |

$48 |

|

WI |

97 |

$189 |

$227 |

$280 |

$150 |

$238 |

$145 |

$96 |

$861 |

$282 |

$106 |

|

WV |

12 |

$185 |

$218 |

$266 |

$169 |

$218 |

$145 |

$112 |

$789 |

$282 |

$161 |

|

WY |

16 |

$286 |

$324 |

$365 |

$259 |

$342 |

$145 |

$90 |

$1,237 |

$282 |

$81 |

NOTE: Premiums shown above are a weighted average of the lowest cost plans in each rating area within a state. Weights are derived from county-level population under the age of 65, projected by the Census Bureau. The average across all 36 states is based on the number of uninsured eligible for the Marketplaces.

Table 2: Premiums and Qualified Health Plan Choices, 36 States (Largest City in State)

|

ate |

City Name |

Number of QHPs24 |

27-Year-Old, Before Tax Credits |

27-Year-Old with an Income of $25,000 |

Family of Four with an Income of $50,00025 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Lowest Bronze |

Lowest Silver |

Lowest Gold |

Lowest Catastrophic |

Second Lowest Silver Before Tax Credit |

Second Lowest Silver After Tax Credit |

Lowest Bronze After Tax Credit |

Second Lowest Silver Before Tax Credit |

Second Lowest Silver After Tax Credit |

Lowest Bronze After Tax Credit26 |

|||

|

AK27 |

Anchorage |

34 |

$254 |

$312 |

$402 |

$236 |

$312 |

$107 |

$48 |

$1,131 |

$205 |

$0 |

|

AL |

Birmingham |

10 |

$170 |

$209 |

$239 |

$140 |

$211 |

$145 |

$104 |

$765 |

$282 |

$134 |

|

AR |

Little Rock |

38 |

$190 |

$241 |

$276 |

$124 |

$251 |

$145 |

$84 |

$909 |

$282 |

$60 |

|

AZ |

Phoenix |

111 |

$139 |

$159 |

$181 |

$105 |

$161 |

$145 |

$123 |

$584 |

$282 |

$202 |

|

DE |

Entire State |

19 |

$203 |

$234 |

$282 |

$137 |

$237 |

$145 |

$111 |

$859 |

$282 |

$158 |

|

FL |

Miami |

137 |

$163 |

$202 |

$239 |

$109 |

$221 |

$145 |

$87 |

$799 |

$282 |

$72 |

|

GA |

Atlanta |

68 |

$166 |

$188 |

$214 |

$127 |

$205 |

$145 |

$105 |

$744 |

$282 |

$138 |

|

IA |

Cedar Rapids |

45 |

$132 |

$171 |

$193 |

$90 |

$189 |

$145 |

$88 |

$683 |

$282 |

$77 |

|

ID |

Boise |

46 |

$145 |

$179 |

$208 |

$128 |

$189 |

$145 |

$101 |

$685 |

$282 |

$122 |

|

IL |

Chicago |

73 |

$125 |

$172 |

$202 |

$141 |

$174 |

$145 |

$96 |

$628 |

$282 |

$106 |

|

IN |

Indianapolis |

31 |

$204 |

$278 |

$348 |

$170 |

$279 |

$145 |

$70 |

$1,011 |

$282 |

$11 |

|

KS |

Wichita |

36 |

$121 |

$162 |

$179 |

$81 |

$162 |

$145 |

$104 |

$587 |

$282 |

$134 |

|

LA |

New Orleans |

52 |

$170 |

$209 |

$238 |

$139 |

$242 |

$145 |

$74 |

$875 |

$282 |

$23 |

|

ME |

Portland |

17 |

$192 |

$233 |

$306 |

$162 |

$242 |

$145 |

$96 |

$876 |

$282 |

$103 |

|

MI |

Detroit |

50 |

$138 |

$156 |

$181 |

$105 |

$184 |

$145 |

$99 |

$665 |

$282 |

$115 |

|

MO |

St. Louis |

20 |

$147 |

$196 |

$213 |

$100 |

$216 |

$145 |

$76 |

$782 |

$282 |

$32 |

|

MS |

Jackson |

22 |

$199 |

$226 |

$258 |

$150 |

$336 |

$145 |

$8 |

$1,216 |

$282 |

$0 |

|

MT |

Bozeman |

26 |

$163 |

$201 |

$219 |

$147 |

$206 |

$145 |

$102 |

$744 |

$282 |

$126 |

|

NC |

Charlotte |

28 |

$183 |

$247 |

$285 |

$115 |

$251 |

$145 |

$77 |

$910 |

$282 |

$36 |

|

ND |

Fargo |

24 |

$175 |

$217 |

$242 |

$128 |

$222 |

$145 |

$98 |

$805 |

$282 |

$110 |

|

NE |

Omaha |

50 |

$162 |

$210 |

$252 |

$114 |

$222 |

$145 |

$84 |

$805 |

$282 |

$62 |

|

NH |

Entire State |

12 |

$186 |

$236 |

$281 |

$157 |

$237 |

$145 |

$94 |

$859 |

$282 |

$96 |

|

NJ |

Entire State |

29 |

$219 |

$253 |

$303 |

$186 |

$260 |

$145 |

$103 |

$943 |

$282 |

$131 |

|

NM |

Albuquerque |

55 |

$126 |

$155 |

$186 |

$110 |

$159 |

$145 |

$112 |

$577 |

$282 |

$162 |

|

OH |

Columbus |

29 |

$205 |

$196 |

$245 |

$151 |

$207 |

$145 |

$142 |

$751 |

$282 |

$273 |

|

OK |

Oklahoma City |

61 |

$105 |

$158 |

$204 |

$107 |

$165 |

$145 |

$85 |

$597 |

$282 |

$66 |

|

PA |

Philadelphia |

42 |

$195 |

$210 |

$250 |

$171 |

$246 |

$145 |

$94 |

$891 |

$282 |

$96 |

|

SC |

Columbia |

28 |

$166 |

$218 |

$244 |

$113 |

$220 |

$145 |

$90 |

$798 |

$282 |

$84 |

|

SD |

Sioux Falls |

32 |

$196 |

$207 |

$251 |

$164 |

$217 |

$145 |

$124 |

$785 |

$282 |

$207 |

|

TN |

Nashville |

72 |

$114 |

$148 |

$197 |

$131 |

$154 |

$145 |

$104 |

$559 |

$282 |

$135 |

|

TX |

Houston |

46 |

$138 |

$195 |

$233 |

$132 |

$201 |

$145 |

$81 |

$728 |

$282 |

$52 |

|

UT |

Salt Lake |

85 |

$143 |

$162 |

$188 |

$110 |

$197 |

$145 |

$91 |

$635 |

$282 |

$109 |

|

VA |

Fairfax County |

56 |

$144 |

$213 |

$258 |

$124 |

$223 |

$145 |

$66 |

$807 |

$282 |

$0 |

|

WI |

Milwaukee |

84 |

$200 |

$247 |

$300 |

$169 |

$258 |

$145 |

$86 |

$935 |

$282 |

$70 |

|

WV |

Huntington |

12 |

$176 |

$208 |

$253 |

$161 |

$208 |

$145 |

$113 |

$753 |

$282 |

$167 |

|

WY |

Cheyenne |

16 |

$271 |

$307 |

$346 |

$245 |

$324 |

$145 |

$92 |

$1,171 |

$282 |

$92 |

Table 3: Premiums and Qualified Health Plan Choices, 25 Metropolitan Statistical Areas in 36 States (Largest Rating Area in MSA)

|

MSA Name |

Number of QHPs28 |

27-Year-Old Rates |

27-Year-Old with an Income of $25,000 |

Family of Four with an Income of $50,00029 |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Lowest Bronze |

Lowest Silver |

Lowest Gold |

Lowest Catastrophic |

Second Lowest Silver Before Tax Credit |

Second Lowest Silver After Tax Credit |

Lowest Bronze After Tax Credit |

Second Lowest Silver Before Tax Credit |

Second Lowest Silver After Tax Credit |

Lowest Bronze After Tax Credit30 |

||

|

Dallas-Fort Worth, TX |

43 |

$153 |

$217 |

$266 |

$173 |

$223 |

$145 |

$74 |

$808 |

$282 |

$26 |

|

Houston-Brazoria, TX |

46 |

$138 |

$195 |

$233 |

$132 |

$201 |

$145 |

$81 |

$728 |

$282 |

$52 |

|

Atlanta, GA |

68 |

$166 |

$188 |

$214 |

$127 |

$205 |

$145 |

$105 |

$744 |

$282 |

$138 |

|

Chicago, IL |

73 |

$125 |

$172 |

$202 |

$141 |

$174 |

$145 |

$96 |

$628 |

$282 |

$106 |

|

Miami-Hialeah, FL |

137 |

$163 |

$202 |

$239 |

$109 |

$221 |

$145 |

$87 |

$799 |

$282 |

$72 |

|

Tampa-St. Petersburg-Clearwater, FL |

102 |

$167 |

$189 |

$218 |

$129 |

$199 |

$145 |

$113 |

$721 |

$282 |

$165 |

|

Phoenix, AZ |

111 |

$139 |

$159 |

$181 |

$105 |

$161 |

$145 |

$123 |

$584 |

$282 |

$202 |

|

Philadelphia, PA |

42 |

$195 |

$210 |

$250 |

$171 |

$246 |

$145 |

$94 |

$891 |

$282 |

$96 |

|

New York-Northeastern NJ |

29 |

$219 |

$253 |

$303 |

$186 |

$260 |

$145 |

$103 |

$943 |

$282 |

$131 |

|

Orlando, FL |

98 |

$182 |

$207 |

$238 |

$141 |

$225 |

$145 |

$102 |

$816 |

$282 |

$126 |

|

Detroit, MI |

50 |

$138 |

$157 |

$181 |

$105 |

$184 |

$145 |

$100 |

$665 |

$282 |

$118 |

|

San Antonio, TX |

58 |

$138 |

$168 |

$192 |

$109 |

$196 |

$145 |

$87 |

$710 |

$282 |

$73 |

|

Fort Lauderdale-Hollywood-Pompano Beach, FL |

132 |

$128 |

$174 |

$189 |

$86 |

$199 |

$145 |

$74 |

$722 |

$282 |

$24 |

|

St. Louis, MO |

20 |

$147 |

$196 |

$213 |

$100 |

$216 |

$145 |

$76 |

$782 |

$282 |

$32 |

|

Indianapolis, IN |

31 |

$204 |

$278 |

$348 |

$170 |

$279 |

$145 |

$70 |

$1,011 |

$282 |

$11 |

|

Charlotte-Gastonia-Rock Hill, NC |

28 |

$183 |

$247 |

$285 |

$115 |

$251 |

$145 |

$77 |

$910 |

$282 |

$36 |

|

Cleveland, OH |

45 |

$152 |

$201 |

$245 |

$121 |

$204 |

$145 |

$93 |

$738 |

$282 |

$94 |

|

Washington DC Metro Area, VA |

56 |

$144 |

$213 |

$258 |

$124 |

$223 |

$145 |

$66 |

$807 |

$282 |

$0 |

|

Pittsburgh, PA |

36 |

$119 |

$134 |

$169 |

$104 |

$139 |

$139 |

$119 |

$505 |

$282 |

$209 |

|

Austin, TX |

76 |

$144 |

$169 |

$193 |

$109 |

$205 |

$145 |

$85 |

$741 |

$282 |

$64 |

|

Salt Lake City-Ogden, UT |

85 |

$143 |

$162 |

$188 |

$110 |

$197 |

$145 |

$91 |

$635 |

$282 |

$109 |

|

West Palm Beach-Boca Raton-Delray Beach, FL |

132 |

$147 |

$167 |

$193 |

$109 |

$220 |

$145 |

$72 |

$797 |

$282 |

$18 |

|

McAllen-Edinburg-Pharr-Mission, TX |

30 |

$109 |

$153 |

$174 |

$98 |

$155 |

$145 |

$99 |

$560 |

$282 |

$117 |

|

Jacksonville, FL |

86 |

$137 |

$186 |

$202 |

$92 |

$210 |

$145 |

$72 |

$760 |

$282 |

$19 |

|

Greensboro-Winston Salem-High Point, NC |

17 |

$167 |

$224 |

$260 |

$105 |

$228 |

$145 |

$84 |

$826 |

$282 |

$62 |

NOTE: For MSAs that include multiple rating areas, this table shows only the largest rating area within that MSA. Rating area population is derived from county-level population under the age of 65, projected by the Census.

Table 4: Weighted Average Premiums, 48 States

|

State |

Lowest Cost Silver |

Second Lowest Cost Silver |

Lowest Cost Bronze |

|---|---|---|---|

|

Weighted Average, 48 States |

$310 |

$328 |

$249 |

|

Alabama |

$303 |

$318 |

$247 |

|

Alaska |

$474 |

$474 |

$385 |

|

Arizona |

$248 |

$252 |

$214 |

|

Arkansas |

$351 |

$366 |

$275 |

|

California |

$341 |

$373 |

$278 |

|

Colorado |

$305 |

$305 |

$232 |

|

Connecticut |

$397 |

$436 |

$340 |

|

Delaware |

$356 |

$360 |

$308 |

|

District of Columbia |

$293 |

$297 |

$204 |

|

Florida |

$304 |

$328 |

$257 |

|

Georgia |

$304 |

$317 |

$265 |

|

Idaho |

$276 |

$285 |

$227 |

|

Illinois |

$274 |

$286 |

$203 |

|

Indiana |

$392 |

$403 |

$304 |

|

Iowa |

$266 |

$287 |

$212 |

|

Kansas |

$260 |

$260 |

$197 |

|

Louisiana |

$356 |

$374 |

$265 |

|

Maine |

$388 |

$403 |

$328 |

|

Maryland |

$266 |

$299 |

$197 |

|

Michigan |

$271 |

$306 |

$222 |

|

Minnesota |

$192 |

$192 |

$144 |

|

Mississippi |

$403 |

$448 |

$342 |

|

Missouri |

$318 |

$334 |

$245 |

|

Montana |

$309 |

$316 |

$251 |

|

Nebraska |

$298 |

$312 |

$241 |

|

Nevada |

$295 |

$297 |

$227 |

|

New Hampshire |

$359 |

$360 |

$282 |

|

New Jersey |

$382 |

$385 |

$332 |

|

New Mexico |

$275 |

$282 |

$217 |

|

New York31 |

$319 |

$349 |

$276 |

|

North Carolina |

$361 |

$369 |

$282 |

|

North Dakota |

$350 |

$353 |

$281 |

|

Ohio |

$304 |

$321 |

$263 |

|

Oklahoma |

$256 |

$266 |

$174 |

|

Oregon |

$241 |

$250 |

$205 |

|

Pennsylvania |

$259 |

$286 |

$229 |

|

Rhode Island |

$341 |

$366 |

$264 |

|

South Carolina |

$333 |

$339 |

$267 |

|

South Dakota |

$341 |

$357 |

$298 |

|

Tennessee |

$235 |

$245 |

$181 |

|

Texas |

$287 |

$305 |

$211 |

|

Utah |

$239 |

$266 |

$201 |

|

Vermont32 |

$395 |

$413 |

$336 |

|

Virginia |

$323 |

$335 |

$237 |

|

Washington |

$350 |

$352 |

$264 |

|

West Virginia |

$331 |

$331 |

$280 |

|

Wisconsin |

$344 |

$361 |

$287 |

|

Wyoming |

$489 |

$516 |

$425 |

NOTE: Premiums shown above are a weighted average of the lowest cost silver plan, the second lowest cost silver plan, and the lowest cost bronze plan in each rating area within the 36 Supported State-based Marketplaces, State Partnership Marketplaces, and Federally-Facilitated Marketplaces as of September 18, 2013, as well as 12 State-based Marketplaces. The rating area weights are constructed based on county-level population under the age of 65. For State-based Marketplaces, premiums are a weighted average across all rating areas for California and New York, and are for the entire state in DC, Rhode Island, and Vermont. For the remaining states, premiums are for the following rating areas: Denver, Colorado; Bridgeport, Hartford, and New Haven, Connecticut; Baltimore, Maryland; Minneapolis and St. Paul, Minnesota; Las Vegas, Nevada; Portland, Oregon; Seattle, Washington. Age weighting for all states is based on expected age distribution in the Marketplaces, estimated by the RAND Corporation.

Methodology

These analyses are based on data submitted to the Centers for Medicare and Medicaid Services (CMS) from 36 states, as well as publicly available premium information from 12 State-based Marketplaces. As Supported State-based Marketplaces, Idaho and New Mexico submitted plan data to CMS for display using Federal web architecture and are included in the 36 state analysis. The data used in this brief are current as of September 18, 2013. At that time, not all issuers’ data had been completely verified in CMS systems. In addition, as of that date, three State-based Marketplaces had not yet published any premium information, and other states had published estimates or incomplete information. Therefore, the premiums presented in this paper should be considered illustrative, not final.

Some State-based Marketplaces have not published all premiums for each issuer. In Maryland, we display the silver plans from the lowest cost issuer and the second lowest cost issuer rather than for the second lowest cost silver plan. For all other states, we display the lowest cost silver plan and the second lowest cost silver plan. The ASPE-derived CBO estimate used for comparison to silver plans is based on the latest CBO premium estimates, adjusted as described in prior ASPE issue briefs.33

We use several different types of weighting in these analyses. To develop an age-weighted average premium within a single rating area, we used the expected age distribution of individual market enrollees in 2014 from the RAND COMPARE Microsimulation model. To develop a statewide average premium across rating areas, we weighted each rating area within a state by the total population under age 65 within that rating area. These population weights were developed using Census projections of county-level population for 2012.34 To develop a nationwide average including all states, we weighted by the number of uninsured potentially eligible for the Marketplace in each state, developed from the 2011 American Community Survey (ACS) Public Use Microdata Sample.35 These estimates represent non-elderly US citizens and legal residents who are uninsured and have incomes above 138% of the Federal Poverty Level in Medicaid expansion states or above 100% of the Federal Poverty Level in non-expansion states. These estimates do not take into account the eligibility requirements relating to other minimum essential coverage.

All premium tax credits presented in this issue brief are calculated based on the 2013 Federal Poverty Guidelines.36 These Guidelines represent the Federal Poverty Levels that will be used for the 2014 plan year.

Notes

1 To be eligible to purchase coverage in a Marketplace, you must be a US citizen or legal resident and not be incarcerated.

2 Tax credit eligibility is dependent on several factors in addition to income, including whether an individual is eligible for Minimum Essential Coverage through their employer, Medicaid, or CHIP.

3 A qualified health plan is a plan certified to be offered in a Marketplace. A health insurance issuer may offer multiple qualified health plans. For example, a silver plan and a bronze plan from Blue Cross and Blue Shield would be considered two qualified health plans.

4 The three states missing from this analysis, Massachusetts, Hawaii, and Kentucky, had not released premium information as of September 16, 2013. Idaho and New Mexico, while State-Based Marketplaces, will be using federal systems to display plans, and are therefore included in the 36 states with data submitted to CMS.

5 See http://aspe.hhs.gov/health/reports/2013/MarketCompetitionPremiums/ib_premiums_update.cfm for a description of the earlier estimates from the Congressional Budget Office.

6 This total excludes catastrophic plans, which are not available to all enrollees. This analysis includes only the 36 states that submitted data directly to CMS, as that data contains a complete accounting of the number of qualified health plans offered in each rating area in each state.

7 The Affordable Care Act requires that qualified health plans offered on the Marketplace must be one of four tiers, or “metal levels,” based on actuarial value (catastrophic plans are exempt from this requirement). Actuarial value is a measure of health plan generosity. A bronze plan has an actuarial value of approximately 60 percent, a silver plan has an actuarial value of approximately 70 percent, a gold plan has an actuarial value of approximately 80 percent, and a platinum plan has an actuarial value of approximately 90 percent.

8 Rating areas are state-defined pricing regions for issuers. They overlap with the issuer service areas in many, but not all, cases. In general, the number of issuers or plans available in a rating area will be the number of choices available to all individuals and families living in that rating area. Issuers are not required to offer a qualified health plan in every rating area within a state, however, so the number of available issuers and qualified health plans varies by rating area. These totals exclude catastrophic plans, which are not available to all enrollees.

9 A health insurance issuer is a company that may offer multiple qualified health plans. For example, a hypothetical Blue Cross and Blue Shield licensed company would be a health insurance issuer, while its $2000 deductible silver plan would be a qualified health plan. An enrollee may have fewer issuers participating in his or her rating area than the total number participating in that state, because issuers are not required to offer a qualified health plan in every rating area.

10 McKinsey & Company. Emerging exchange dynamics: Temporary turbulence or sustainable market disruption? September 2013.

11 For a discussion of methodology, see http://aspe.hhs.gov/health/reports/2013/MarketCompetitionPremiums/ib_premiums_update.cfm.

12 Based on analysis of the the 2011 American Community Survey (ACS), available at http://cms.gov/Outreach-and-Education/Outreach/HIMarketplace/Census-Data-.html?no_redirect=true. Eligible uninsured is defined as uninsured Americans who are citizens or legal residents under the age of 65 and therefore eligible for coverage either in the Marketplace or through Medicaid. We define Marketplace eligible as the eligible uninsured with incomes above 138% of the Federal Poverty Level in Medicaid expansion states or above 100% of the Federal Poverty Level in non-expansion states. These estimates do not take into account the eligibility requirements relating to other minimum essential coverage.

13 Tax credits are not available for catastrophic plans.

14 This analysis includes only the 36 states that submitted data directly to CMS, as not all 12 of the State-based Marketplaces with available premium data have released catastrophic premiums.

15 Estimated using the 2011 American Community Survey (ACS) Public Use Microdata Sample. This estimate includes US citizens and legal residents between the ages of 25 and 30 who are uninsured and may be eligible for the Marketplace or Medicaid in 2014. The estimates do not take into account whether an individual may have access to Minimum Essential Coverage through an employer.

16 This analysis concerns only tax credits and premium costs, but we note that cost sharing reductions are not available in bronze plans except for American Indians and Alaska Natives. Cost sharing reductions are available to individuals and families with incomes below 250 percent of the FPL who enroll in silver plans, and to American Indians and Alaska Natives enrolled in metal level. These cost sharing reductions reduce consumer costs (such as out-of-pocket maximums, copays, and coinsurance) at the point of service, whereas tax credits reduce only premiums.

17 Because the tax credit is calculated as the difference between the cost of the second lowest cost silver plan premium and the maximum payment amount determined by income, those with higher premiums get larger tax credits. Therefore, using tax credits to purchase a bronze plan may yield lower net bronze premiums in higher-cost states or for older individuals and families.

18 See http://aspe.hhs.gov/health/reports/2013/Uninsured/ib_uninsured.cfm.

19 The 36 states included in this analysis are the Supported State-based Marketplaces, State Partnership Marketplaces, and Federally-facilitated Marketplaces, for which ASPE has complete data. We do not include State-based Marketplace data here.

20 Not including catastrophic plans.

21 For the purposes of this analysis, a family of four is defined as one 40-year-old adult, one 38-year-old adult, and two children under the age of 18.

22 After tax credits, bronze premiums for a family of four may be below those for a single individual. This occurs because the tax credit is calculated as the difference between the cost of the second lowest cost silver plan premium and the maximum payment amount determined by income. Because premiums for older individuals and families are higher than those for younger individuals, tax credits are larger for older individuals and families. Therefore, using tax credits to purchase a bronze plan may yield lower bronze premiums for older individuals and families than for younger individuals.

23 Alaska has an alternate Federal Poverty Level, which is used to calculate tax credits here.

24 Not including catastrophic plans.

25 For the purposes of this analysis, a family of four is defined as one 40-year-old adult, one 38-year-old adult, and two children under the age of 18.

26 After tax credits, bronze premiums for a family of four may be below those for a single individual. This occurs because the tax credit is calculated as the difference between the cost of the second lowest cost silver plan premium and the maximum payment amount determined by income. Because premiums for older individuals and families are higher than those for younger individuals, tax credits are larger for older individuals and families. Therefore, using tax credits to purchase a bronze plan may yield lower bronze premiums for older individuals and families than for younger individuals.

27 Alaska has an alternate Federal Poverty Level, which is used to calculate tax credits here.

28 Not including catastrophic plans.

29 For the purposes of this analysis, a family of four is defined as one 40-year-old adult, one 38-year-old adult, and two children under the age of 18.

30 After tax credits, bronze premiums for a family of four may be below those for a single individual. This occurs because the tax credit is calculated as the difference between the cost of the second lowest cost silver plan premium and the maximum payment amount determined by income. Because premiums for older individuals and families are higher than those for younger individuals, tax credits are larger for older individuals and families. Therefore, using tax credits to purchase a bronze plan may yield lower bronze premiums for older individuals and families than for younger individuals.

31 New York premiums are the same for all ages.

32 Vermont premiums are the same for all ages.

33 See http://aspe.hhs.gov/health/reports/2013/MarketCompetitionPremiums/ib_premiums_update.cfm

34 See http://www.census.gov/popest/data/counties/asrh/2012/CC-EST2012-ALLDATA.html.

35 For data and further methodological details, see http://cms.gov/Outreach-and-Education/Outreach/HIMarketplace/Census-Data-.html?no_redirect=true.