Contract HHSP23320045017XI

Task Order HHSP233200700003T

Prepared for:

Department of Health and Human Services, Office of the Assistant Secretary for Planning and Evaluation

Prepared by:

The Lewin Group and

i3 Innovus

July 2009

This report was prepared by The Lewin Group, Inc., in collaboration with i3 Innovus. Staff contributing to this report include: Clifford Goodman, PhD*, Joanna Campbell, PhD†, Erin Karnes*, Laura Peterson*, Shalini Naik, MS†, Kristen Nunes†, William Vogt, PhD‡, Deborah Marshall, PhD†, Steve Clark†, Bengt Jönsson, PhD†, and William Crown, PhD†. The Lewin Group and i3 Innovus gratefully acknowledge the guidance and support of Amber Jessup, PhD, of the Office of the Assistant Secretary for Planning and Evaluation, Department of Health and Human Services.

* The Lewin Group

† i3 Innovus

‡ National Bureau of Economic Research

Unlike most conventional drugs, biological products are usually large, complex molecules that are produced by living organisms. These commercially engineered biologics currently account for billions of dollars in health care spending. Starting early last century, Congress has regulated most biologics separately from small molecules under the Biologics Control Act, which was later incorporated into the Public Health Service (PHS) Act. Although some biologics are regulated under the Federal Food, Drug, and Cosmetic Act (FDCA) for historical reasons, and are, therefore, candidates for generic production through section 505(j), an Abbreviated New Drug Application (ANDA), or through 505(b)(2), using data from previously approved innovator biologics to make claims of safety and effectiveness, there is no abbreviated path for replica or closely similar follow-on products for biologics under the PHS Act. While this group of products is known by various names, this report uses the term “follow-on protein products” (FoPPs).

Due to the potential cost savings that FoPPs could provide in the US market, members of Congress have made various proposals for establishing a regulatory pathway for FoPPs. The purpose of this report is to provide an unbiased estimate of potential cost savings from the introduction of FoPPs under multiple scenarios for abbreviated regulatory pathways. Findings from this analysis may be useful in the context of ongoing policy deliberations. A better understanding of the potential impact of legislative provisions for the regulatory pathway on cost savings may inform policymakers as such a pathway is considered.

This report was prepared by The Lewin Group and i3 Innovus under contract to the Assistant Secretary forPlanning and Evaluation. The findings and conclusions of this report are those of the author(s) and do not necessarily represent the views of ASPE or HHS. Material contained in this publication is in the public domain and may be reproduced, fully or partially, without permission of the Federal Government.

"I. Executive summary

Background & Purpose

Unlike most conventional drugs, biological products are usually large, complex molecules that are produced by living organisms such as yeast or mammalian cells. These commercially engineered biologics currently account for billions of dollars in health care spending. Starting early last century, Congress has regulated most biologics separately from small molecules under the Biologics Control Act, which was later incorporated into the Public Health Service (PHS) Act. Although some biologics are regulated under the Federal Food, Drug, and Cosmetic Act (FDCA) for historical reasons, and are, therefore, candidates for generic production through section 505(j), an Abbreviated New Drug Application (ANDA), or through 505(b)(2), using data from previously approved innovator biologics to make claims of safety and effectiveness, there is no abbreviated path for replica or closely similar follow-on products for biologics under the PHS Act. While this group of products is known by various names, this report uses the term "follow-on protein products" (FoPPs). Because of their different molecular nature and mode of production compared to small molecule drugs, synthesizing truly identical generic versions of original biologics is regarded as unlikely. However, due to the size of the market, and as more originator (or "branded") products approach expiration of their intellectual property, there is an increased interest in exploring FoPPs and creating a regulatory pathway under the PHS Act that is analogous to 505(b)(2) or 505(j) under the FDCA.

To date, at least six FoPPs have been approved in the US by the FDA, perhaps the most prominent of which is a follow-on of somatropin. Sandoz's Omnitrope® is a biologic intended to replicate the recombinant human growth hormone (hGH), somatropin (Genotropin®, Pfizer), which is regulated under the FDCA. Since hGH products are approved under the FDCA, the abbreviated approval of Omnitrope® does not establish a pathway for follow-on versions of biologics regulated under the PHS. Unlike the US , Europe has created a "biosimilars" program, which uses a case-by-case approach to regulate FoPPs, requiring some clinical efficacy and safety data for market approval. At the time of this report, 13 FoPPs had been approved by the European Medicines Agency (EMEA) through their biosimilars program. Six of these FoPPs are for granulocyte colony-stimulating factor (G-CSF), two are for hGH, and five are for erythropoietins. Although the biosimilars program established a model of a regulatory pathway and has approved its first products, the data on market performance are only emerging.

Due to the potential cost savings that FoPPs could provide in the US market, members of Congress have made various proposals for establishing a regulatory pathway for FoPPs. Five bills were introduced in the 110th Congress and referred to committee; however, none were reported out of committee or received a vote. To date, two bills have been introduced in the 111th Congress related to FoPPs. Controversy surrounds the various approaches proposed in these bills, particularly given the high prices associated with biologics and the likelihood of price discounts with the introduction of FoPPs. Three studies released in early 2007 generated estimates of the cost savings that could result from patent expiration of branded biologics and the emergence of corresponding FoPPs assuming the approval of a regulatory mechanism under the PHS Act. While these analyses started with similar goals, they generated divergent estimates.

The purpose of this report is to provide an unbiased estimate of potential cost savings from the introduction of FoPPs under multiple scenarios for abbreviated regulatory pathways. Findings from this analysis may be useful in the context of ongoing policy deliberations. A better understanding of the potential impact of legislative provisions for the regulatory pathway on cost savings may inform policymakers as such a pathway is considered.

Methodology

The first of two stages of research and analysis identified the likely candidates for FoPPs. In this stage, we examined broad categories of biological products using searches of the Internet, published literature, and other sources (e.g., market research reports) to locate relevant information. We also conducted semi-structured interviews with experts from federal agencies, industry, academia, and health economists. Each biologic category was examined with regard to criteria identified as important through the preliminary search and interviews. The results of this review informed the selection of a subset of biologic categories for further consideration. We then analyzed individual biologics within these selected categories based on additional criteria identified as relevant to the potential for development of a FoPP. From these analyses, we generated a list of the most likely candidates for FoPPs.

Estimation of the cost impact of FoPP competition for the selected biologic drugs proceeded in two stages. First, we estimated costs associated with the utilization of the originator biologic products, assuming the status quo of no FoPP entrants (sometimes identified here as the "world without" scenario). We then estimated total costs for the "world with" scenario, which includes the costs associated with the originator biologic products and any competing FoPP(s). Describing the "world with" scenario involved modeling changes in current marketplace dynamics resulting from the introduction of FoPPs, including anticipated: (1) lower prices, (2) substitution away from originator biologics currently on the market, and (3) market expansion. The net difference between the "world without" and "world with" costs is the estimate of the incremental cost impact associated with the entry of FoPPs.

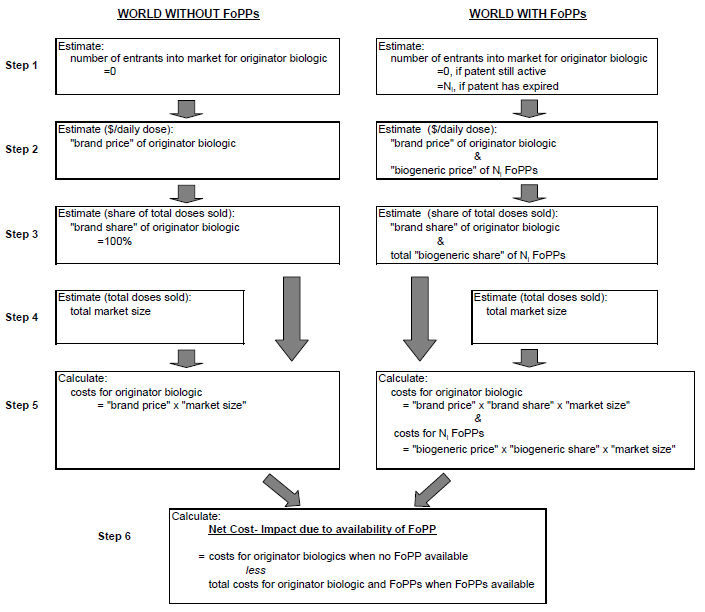

The analysis used a high-level approach to estimating the potential cost impact associated with competition from FoPPs, suitable for accommodating drugs spanning multiple, widely varying disease areas. We characterized each originator product along a series of dimensions, including market size, molecular complexity, pre-entry market competitiveness, and fixed costs of FoPP entry. These product characteristics were inputs into models of FoPP entry, the subsequent evolution of brand and FoPP prices, overall market size, and brand and FoPP market shares, i.e., the components necessary to calculate the cost-impact of FoPP entry. The models of market entry, pricing and demand were grounded in a series of microeconomic studies of the economics of the pharmaceutical industry generally, and the biological industry specifically.[1],[2],[3],[4],[5] Default parameter estimates were derived from the published literature and market studies, supplemented by input from experts in clinical matters, pharmacoeconomics and pharmaceutical economics. A summary description of the approach is provided in Figure 1.

Figure 1: Schematic of Model Framework for Analysis of Cost Impact of

FoPP Availability (Base-Case Analysis)

Figure 1 is entitled "Schematic of Model Framework for Analysis of Cost Impact of FoPP Availability (Base-Case Analysis)". The figure is a diagram of two columns, one being "WORLD WITHOUT FoPPs" and the second being "WORLD WITH FoPPs." Each column has 5 seperate steps of calculations which then lead to Step 6, which is a calculation shared by both columns. This particular diagram demonstrates the likely number of FoPP entrants is a key determinant of the estimates of cost impact of FoPP competition.

The base-case analysis of the incremental cost impact associated with FoPP availability used straightforward assumptions regarding FoPP entry, FoPP pricing, FoPP market share, and overall market size. The model was then run iteratively under a series of alternative assumptions on entry, pricing, market share and market size. Finally, the base case results were subjected to sensitivity analyses involving variation of selected underlying model parameters through a pre-determined range of plausible values. Particular attention was given to modeling varying assumptions designed to represent a potential range of

Results

From the 10 original categories of biologics considered, 6 categories of biologics were selected for further analysis based on input from experts and the results of our initial research, including:

- Erythropoietin (EPO)

- Cancer monoclonal antibodies (MAbs)

- Anti-tumor necrosis factor (anti-TNF) agents

- Interferon beta

- Granulocyte-colony stimulating factor (G-CSF)

- Interferon alpha

Within these categories, only individual products that ranked in the top 20 biologics according to 2006 sales were evaluated. Among the categories considered, the following biologics were selected as the most likely candidates for FoPPs:

- Procrit®/EPOGEN® (EPO)

- Rituxan® (MAb)

- Herceptin® (MAb)

- Avastin® (MAb)

- Enbrel® (anti-TNF)

- Remicade® (anti-TNF)

- Avonex® (interferon beta)

- Rebif® (interferon beta)

- Neupogen® (G-CSF)

- Pegasys® (interferon alpha)

Projected cost savings associated with establishing a regulatory pathway for FoPPs are based on modeling the anticipated experience with FoPPs for these 10 products.

Under the base case scenario:

- Biologic markets are assumed to open to FoPP competition after patent expiry and the expiry of a data exclusivity period of 12 years.

- FoPP entry is therefore assumed to occur no earlier than 2012.

- Our model projects that the number of FoPP entrants will range from zero (for Pegasys®) to three (for the EPOs, and Avastin®) over the period 2009-2019.

- FoPP entry is therefore assumed to occur no earlier than 2012.

- The small number of entrants is estimated to be accompanied by maximum FoPP price discounts of 20% (for Avastin) and FoPP market shares of 54% (for Neupogen).

- The price discounts associated with FoPP entry are estimated to result in an additional (induced) increase in the overall demand for these products of at most 4%.

- Under these base case assumptions, cost savings from entry of FoPPs total $9.97 billion dollars over the period 2009-2019.

- $5.3 billion of this is estimated to accrue to private payers.

- $4.65 billion of this is estimated to accrue to public payers.

- $5.3 billion of this is estimated to accrue to private payers.

These estimates are most sensitive to assumptions about the size of eventual FoPP price discounts and brand price inflation in the context of FoPP competition.

- For example, assuming FoPP price discounts of 40% increases the estimate of cost savings by a factor of four, to $44 billion.

- Assuming decreases in brand prices averaging 1.5% per year also increases the estimate of cost savings, to approximately $40 billion.

- In contrast, the effect of varying assumptions on the rigor of the regulatory process, modeled by varying the time to first entry of FoPPs and the fixed cost of FoPP entry, has smaller effects on estimated cost savings.

- Delaying entry of FoPPs by five years lowers the estimate of overall cost savings for the period 2009-2019 by $7.9 billion.

- Assuming that all FoPP entrants will be required to field the equivalent of a 900-person clinical trial lowers the estimate of overall cost savings by $1.5 billion.

- The estimate of cost savings is sensitive to additional FoPP entries in years after the biologic markets first open to competition, as well the manner in which the fixed costs of entry for FoPPs are estimated.

- Assuming that, in years subsequent to the first year of opening of the markets, there will be two additional FoPP competitors for each product increases the estimated cost impact to $16.5 billion.

- Assuming that potential FoPP manufacturers generally would be required to build entirely new production facilities rather than take advantage of existing capacity significantly reduces the estimated number of FoPP entrants and resulting cost savings to negligible levels, i.e., less than $0.5 billion.

- Assuming that, in years subsequent to the first year of opening of the markets, there will be two additional FoPP competitors for each product increases the estimated cost impact to $16.5 billion.

Conclusions and Policy Implications

The matter of expediting competition in the costly and rapidly evolving therapeutic biologics market has great medical and economic significance. Proposed approaches involve abbreviated regulatory approval pathways analogous to the 505(b)(2) or 505(j) processes for drugs regulated under FDCA. In this analysis, we attempt to quantify the financial impact of expedited competition of FoPPs in major therapeutic biologics markets.

The uncertainty associated with market response to FoPP entry is demonstrated by the variation in estimates reported in prior studies. Our analysis combines microeconomic models of the pharmaceutical industry with empirical data and the considered opinion of clinical experts and experts in the fields of pharmacoeconomics and pharmaceutical economics to systematically address the question of “How would FoPP entry affect expenditures on major biologics?”

Our base case analysis estimates total cost savings of $10 billion over the period 2009-2019, assuming entry of the first FoPP into the markets considered no earlier than 2012. Notably, six of the ten biologics that we assess are not expected to be exposed to FoPP competition until 2014 or later. Of even greater significance is that our estimates of the likely fixed costs of entry associated with satisfying clinical requirements similar to those required by the EMEA are projected to limit the number of market entrants per biologic to at most three, and in most cases two or less. As a consequence of the relatively small number of predicted entrants, our estimate of the accompanying FoPP price discount is also low, in the range of 12–20%.

The ability of regulatory authorities to affect this estimate varies in the context of this model. We assume that increased regulatory rigor would arise in the form of requirements to generate greater amounts of clinical evidence, delaying the time to FoPP market entry. Moreover, any requirement for FoPP manufacturers to follow published FDA guidance is likely to introduce further delays. Delaying projected FoPP entry in each market by two years reduces estimated cost savings by $3.4 billion from the base case, or 34%. Further, additional requirements for clinical evidence are more costly to implement. Requiring all FoPP entrants to meet a “very high clinical standard,” which we model as having to conduct a clinical trial involving 900 patients, reduces projected overall cost savings by $1.5 billion from the base case, or about 15%.

In addition to considering alternative scenarios of regulatory rigor, we conducted multiple additional sensitivity analyses around the baseline assumptions at each stage of the analysis including: the year in which branded biologics are exposed to FoPP competition, the increase/decrease in utilization for branded biologic drugs over the period, the size of the fixed costs of entry for FoPP manufacturers, the number of eventual FoPP entrants into each market, the price discounts offered by FoPP manufacturers, brand price inflation in the context of FoPP competition, and the market shares captured by FoPP entrants.

Our sensitivity analyses suggest that the effect of variation in regulatory requirements is small compared to the effect of variation in pricing behavior by originator and FoPP manufacturers. Indeed, the estimates of cost savings are most sensitive to assumptions about the size of FoPP price discounts. If FoPP manufacturers discount conservatively, then projected cost savings will be relatively small. If, however, the opening of the market brings about highly competitive behavior on the part of the originator or FoPP manufacturers, projected cost savings over the period 2009-2019 can be significant, i.e., in excess of $40 billion.

II. Introduction

Background

1. US Regulation of Chemical Small Molecules vs. Biological Products

Most conventional drugs, from aspirin to beta-blockers to statins, comprise small molecules produced using a form of chemical synthesis. In contrast, biological products are usually large, complex molecules that are produced by living organisms such as yeast or mammalian cells. Examples are vaccines, blood and blood products, and insulin. Today, certain commercially bioengineered biologics such as erythropoiesis-stimulating agents and granulocyte colony stimulating factors account for billions of dollars in health care spending. US sales of biologics are expected to exceed $60 billion by 2010.[6]

Small molecules are regulated under the Federal Food, Drug, and Cosmetic Act (FDCA), passed in 1938 to establish a new approval process for drugs. The FDCA includes the 1984 Hatch-Waxman amendments, which established the prevailing drug approval scheme in the US . In brief, under this scheme, most novel drugs ("new chemical entities" [NCEs]) are approved under a New Drug Application (NDA), which pertains to safety and effectiveness as well as patents claiming the drug product and methods for using it (i.e., section 505(b)). The Hatch-Waxman Act provides five years of market exclusivity to the sponsor of an NCE, during which time applications cannot be submitted for alternate versions of the NCE. Further, sponsors can receive three more years of market exclusivity for modifications to existing products that require new clinical investigations. This extended exclusivity prevents Food and Drug Administration (FDA) approval of a generic product with the same modification or a new indication during that time. One method of permission to a generic drug sponsor to market its product is provided through FDA approval of an Abbreviated New Drug Application (ANDA) as described in section 505(j) of the FDCA. Under an ANDA, a generic drug must have the same active ingredient as the original product and the same indications of use, route of administration, dosage form, strength, and (in most instances) labeling as the original product. Having the identical active ingredients as the original product, approval of a generic as safe and effective generally relies on safety and effectiveness data submitted with the original product. An alternative method for generic approval is provided through section 505(b)(2) of the FDCA, commonly referred to as the "paper NDA." FDA has taken the position that a 505(b)(2) permits the applicant to file an NDA that does not contain full reports of clinical studies proving safety and effectiveness, and, instead, references a previously approved innovator product.[7]

Starting with the Biologics Control Act early in the last century, Congress has regulated most biologics separately from small molecules. In 1944, the Biologics Control Act was incorporated into the Public Health Service (PHS) Act, under which biologics are still regulated today. (For historical reasons, certain biologics are regulated under the FDCA, including human growth hormone (hGH), calcitonin, and hyaluronidase.) Consistent with this different regulatory status for biologics, FDA provided a different regulatory scheme for these products. As opposed to the NDA process, marketing of biologics requires FDA approval of a Biological License Application (BLA), which pertains to both the biologic product itself and the producing facility. The PHS Act does not provide an abbreviated approval scheme for products intended to be replicas or closely similar follow-on products.[8] While these products are known by various names (e.g., biosimilars, biogenerics), this report uses the term "follow-on protein products" (FoPPs).

Because of their different molecular nature and mode of production compared to small molecule drugs, producing truly identical generic versions of original biologics is regarded currently as unlikely or impossible. As more originator (or "branded") biologics approach expiration of their intellectual property, there are opportunities for sponsors to develop similar or follow-on products, if not true generic versions. However, the absence of a regulatory pathway under the PHS Act that is analogous to either the 505(j) (ANDA) or 505(b)(2) (paper NDA) pathways under the FDCA complicates the market environment for producing FoPPs that could compete with the original biologics and lower prices in the manner that generics have done for small molecule drugs.

2. Early Experience with US Regulation of FoPPs

To date, at least six FoPPs have been approved by the FDA through section 505(b)(2) of the FDCA.[9] Some examples of products approved through this mechanism to date are: Hylenex® (hyaluronidase recombinant human, Baxter), HydaseTM (hyaluronidase, Akorn), Amphadase® (hyaluronidase, Amphastar), Fortical® (calcitonin salmon recombinant, Upsher-Smith) Nasal Spray, GlucaGen® (glucagon, Novo Nordisk), and Omnitrope® (somatropin, Sandoz).[10] While it is not the first approved FoPP, the case of the somatropin follow-on is of particular importance because it is the first instance of a human growth hormone (hGH) FoPP, i.e., a relatively more complex biologic, approved through the FDA 505(b)(2) process.

Sandoz's Omnitrope® is a biologic intended to replicate the recombinant hGH, somatropin, which is regulated under the FDCA. After several years of consultation with the FDA, Sandoz filed an abbreviated application for Omnitrope® in July 2003. The application consisted of physiochemical, pharmacokinetic, pharmacodynamic, and clinical data comparing Omnitrope® with the innovator drug, Genotropin® (Pfizer). The clinical comparative data submitted came from two controlled trials in pediatric subjects. These data, in combination with the FDA's prior finding that the innovator drug is safe and effective, were intended to support the conclusion that Omnitrope® is also safe and effective for the same indications as the innovator drug, including indications for which Omnitrope® was not studied. [11],[12],[13] Following a year of deliberation, the FDA was still unable to reach a decision whether or not to approve the drug. As a result, Sandoz filed a suit with federal courts forcing the FDA to make a decision. Ultimately, the FDA approved Omnitrope® for use in the US in May 2006, concluding that, while the active ingredient was not identical to the active ingredient of the innovator product, it was highly similar and shared the same molecular weight.[14] While still considered a FoPP to Genotropin®, Omnitrope® has not been rated by the FDA as therapeutically equivalent to Genotropin® or any previously approved hGH product.[15] Since all hGH products are approved under the FDCA, the abbreviated approval of Omnitrope® does not establish a pathway for follow-on versions of biologics regulated under the PHS Act.

3. European Biosimilars Program

While experience with regulation of FoPPs in the US is currently limited to biologics under the FDCA, Europe presents a potential model for a new regulatory pathway for FoPPs in the US . In its "biosimilars" program, Europe has taken a case-by-case approach in regulating FoPPs, requiring some clinical efficacy and safety data for market approval. As implemented by the European Medicines Agency (EMEA), this program provides 10 years of market exclusivity (which can be extended for one year for new therapeutic indications) for a reference (i.e., originator) product against generic, hybrid, or similar biological products.[16]

The first two FoPPs were approved under the biosimilars program in 2006. These were two hGH FoPPs to somatropin, which is produced as branded products Genotropin® (Pfizer) and Humatrope® (Eli Lilly). The FoPPs for these products are known as Omnitrope® (Sandoz) and Valtropin® (Biopartners), respectively. Although it is generally acknowledged that price discounts resulting from the availability of FoPPs are unlikely to reach the amounts with generic versions of regular/small molecules, early experience with Omnitrope® in Germany suggests that the discounts may still be significant.[17] The global market for hGH is about $2.47 billion.[18] In Germany , Sandoz launched Omnitrope® at a 20% discount, and Omnitrope® currently sells for approximately 25% less than Genotropin®.[19] Although these price discounts might have been expected to yield significant savings for consumers and the health system, market share to date for these products across most of Europe is only a few percent. (Undocumented reports suggest that market share in Poland may exceed 50%.[20])

Five additional FoPPs were approved by the EMEA in 2007. The approved FoPPs are based on Johnson & Johnson's erythropoiesis-stimulating agent (ESA), Eprex (marketed as Procrit® in the US ). Binocrit® (Sandoz GmbH), Epoetin alfa Hexal® (Hexal Biotech Forschungs GmbH), and Abseamed® (Medice Arzneimittel Pütter GMBH & Co.) are all epoetin alphas, while Silapo® (Stada Arzneimittel AG) and Retacrit® (Hospira Enterprises B.V.) are epoetin zetas.[21],[22] The current global market for ESAs is $11.94 billion annually, posing a considerable target for competition by biosimilars.[23] Of note in this market is that all three epoetin alphas are products of a single company (Rentschler Biotechnologie GmbH) and that the two epoetin zetas are products of a single company (Norbitec GmbH).

In 2008, six FoPPs for granulocyte colony-stimulating factors (G-CSFs) were approved by the EMEA. XM02, manufactured by Sicor Biotech UAB in Vilnius, Lithuania, has been approved for sale as Biograstim (CT Arzneimittel), Filgrastim Ratiopharm (Ratiopharm), Ratiograstim (Ratiopharm) and Tevagrastim (Teva Pharmaceuticals).[24],[25],[26],[27] Filgrastim, manufactured by Sandoz in Austria, has been approved for sale as Filgrastim Hexal (Hexal Biotech Forschungs GmbH) and Zarzio (Sandoz GmbH).[28],[29] These are biological medicinal products similar to the reference product Neupogen™ (filgrastim) authorized in the EU. The market for G-CSFs is $4.36 billion annually.[30] Similar to the ESA market, while there are six filgrastim follow-ons, only two companies actually manufacture these biologics: Biotech UAB and Sandoz.

Although the biosimilars program established a model of a regulatory pathway and has approved its first products, the data on market performance are only recently emerging. The European experience with regulation of FoPPs may differ from what may arise in the US . Consumption levels of these products tend to be lower in Europe than in the US (although lower prices for the FoPPs could increase European consumption). Reference pricing used in Europe may make the market for FoPPs less attractive by placing additional downward price pressure on the original product once FoPPs enter the market.

4. US Proposals to Establish a Regulatory Pathway for FoPPs

Members of Congress and other policymakers have put forth various proposals for establishing a regulatory pathway for FoPPs. During the 110th Congress, five bills were introduced in the House and Senate and referred to committee. While none of these bills were reported out of committee or received a vote, it is likely that similar proposals will arise in the 111th Congress. To date, two unique bills (three bills in total) have been introduced in the 111th Congress related to biosimilars, including a reintroduction of The Access to Life Saving Medicine Act, now entitled The Promoting Innovation and Access to Life Saving Medicine Act by Representative Waxman and Senator Schumer and a reintroduction of The Pathway for Biosimilars Act by Representative Eshoo. Key provisions from each bill in the 110th and 111th Congress are provided below.

111th Congress, H.R. 1548/S.726: The Promoting Innovation and Access to Life-Saving Medicine Act[31]

Reintroduction of 110th Congress, H.R. 1038/S. 623: The Access to Life-Saving Medicine Act[32])

- Allows a company to file an abbreviated biological product application with the FDA that includes:

- Data demonstrating that the product is comparable to or interchangeable with the innovator product

Information to show that the conditions in the labeling proposed for the FoPP have been previously approved for the innovator product - Information to show that the route of administration, dosage, and strength of the FoPP are the same as the reference product

- Data demonstrating that the product is comparable to or interchangeable with the innovator product

- Allows the FoPP applicant to request FDA make a determination of the interchangeability of the FoPP and the reference product

- Provides the innovator product five years of market exclusivity and an additional six months of market exclusivity for pediatric applications

- The version introduced in the 110th Congress did not provide a period of market exclusivity for the innovator product

- The version introduced in the 110th Congress did not provide a period of market exclusivity for the innovator product

- Provides the innovator product with a total of eight years of market exclusivity if an additional indication is approved

- Provides a period of up to 36 months of market exclusivity for the first FoPP

111th Congress, H.R. 1548: The Pathway for Biosimilars Act

Figure 2 is entitled "Schematic of Model Framework for Analysis of Cost Impact of FoPP Availability (Base-Case Analysis)". The figure is a diagram of two columns, one being "WORLD WITHOUT FoPPs" and the second being "WORLD WITH FoPPs." Each column has 5 seperate steps of calculations which then lead to Step 6, which is a calculation shared by both columns. This particular diagram demonstrates the likely number of FoPP entrants is a key determinant of the estimates of cost impact of FoPP competition.

In this model, the likely number of FoPP entrants is a key determinant of the estimates of cost impact of FoPP competition (following Grabowski et al. 2007). Fewer FoPP entrants will yield less competition, a higher relative FoPP price (lower discount on FoPPs), and smaller cost impact. Additional determinants derived in the model include the FoPP price discount, the degree of market uptake of FoPPs (captured by FoPP market share), and expansion of overall market size in response to (presumably less expensive) FoPP alternatives. The modules estimating market entry, pricing and demand are grounded in a series of microeconomic studies of the economics of the pharmaceutical industry generally, and the biological industry specifically[62],[63],[64],[65],[66],[67] Default parameter estimates external to the model were derived from the published literature, market research studies, supplemented by the input of clinical consultants and experts in

Step 1: Estimating the number of entrants into a biologic product market

Step 1 in the model, the estimation of the number of FoPP entrants, is based on a re-formulation of the framework proposed in the Grabowski et al. (2007) paper, "Entry and competition in generic biologicals," which makes use of the market entry framework of Bresnahan and Reiss (1991).[68] The details of the derivation are presented in the technical Appendix A. We chose the Grabowski framework as a methodological point of reference because it was one of the few papers to explicitly model entry into a biologics (rather than generics) market.

Estimation of FoPP entry into the market for a specified biologic proceeds in two steps. First, the entry decision is analyzed as if the market were one for small-molecule drugs; the resulting estimate of the number of FoPP entrants is then adjusted for institutional differences between markets for biologics and small molecule drugs. Thus, we first estimate the number of generic entrants expected to enter a standard small molecule market equivalent in size to the biologic market of interest (as measured by market revenue). This number is then adjusted for differences between the markets for biologics and small molecules in price-cost margins and fixed costs of entry.

Step 2: Estimating "brand" and "FoPP" prices

Step 2 of our model, estimating the brand price after FoPP entry and FoPP price discount, draws on the analysis of Reiffen and Ward (2005) and Bhattacharya and Vogt (2003). In this stage, we model the FoPP price relative to the "brand" price as a function of the expected number of FoPP entrants.

The choice of Reiffen and Ward merits additional discussion. An important attribute of their analysis is the estimation of the discount attributed to generic entry as a non-linear function of the number of generic competitors. However, the estimated discounts associated with generic entry are somewhat smaller than those of alternative analyses, e.g., Saha et al. (2006) and Grabowski et al. (2007). We contend (based on our stage 1 analysis and supported by the biosimilar experience in Europe) that high fixed costs of entry into these markets are likely to result in few FoPP entrants per drug. The effect of few competitors is bolstered by the expectation that FoPP products are unlikely to be considered identical to the innovator products. (We return to this point in greater detail, below). Biologic markets after FoPP entry may, therefore, be better characterized as imperfectly competitive, even oligopolistic markets, resulting in smaller price discounts than would occur in a market with either much greater numbers of entrants or non-differentiated products.

Step 3: Estimating "brand" and "FoPP" market shares

Step 3 of our model, estimating the cumulative FoPP market, share draws on the analysis of Saha et al. (2006). As we are interested only in predicting market share, rather than analyzing the structural relationships between the determinants, we use the OLS analyses of Saha et al. to estimate FoPP market share as a function of FoPP price discount, the number of FoPP entrants, the overall market size, and the level of HMO coverage within the market.

Step 4: Estimating market size post-FoPP entry

Multiple studies of pharmaceutical benefits design (e.g., Gaynor, Li and Vogt, 2007; and Joyce et al., 2002)[69],[70] have demonstrated that the demand for pharmaceutical products decreases as prices increase. Similarly, the entry of FoPPs and the associated biosimilar price discount are anticipated to induce an increase in pharmaceutical demand and, therefore, in market size.[71] Although some studies show that generic entry in the small molecule market can depress overall market size as brand producers cut back on advertising, we believe that this effect will be negligible in the biologic market, as FoPP producers are likely to try and establish an independent market identity (as does, e.g., Sandoz's Omnitrope®, which is a FoPP for Pfizer's hGH, Genotropin®).

Therefore, we model the increase in market size as a function of the weighted decrease in price, where the weights are the relative "brand" and "FoPP" market shares, which are affected, in turn, by the predicted number of FoPP entrants.

Steps 5-6: Estimating cost impact FoPP entry

The model calculates cumulative cost impact over the period 2009-2019. The base-case analysis of the incremental cost impact associated with FoPP availability uses straightforward assumptions to estimate FoPP entry, FoPP pricing, FoPP market share, and overall market size. The model then re-calculates the cost impact under a series of alternative assumptions on entry, pricing, market share and market size. Finally, the base case results are subjected to sensitivity analyses involving variation of selected underlying model parameters through a pre-determined range of plausible values.

Given the uncertainty regarding new approval pathways for FoPPs, it is important to develop estimates of the cost impact of the availability of FoPPs that are sensitive to the effects of differing levels of rigor for regulatory approval. In this model, the rigor of the approval model affects the estimated cost impact through two pathways: 1) the time to market entry of the FoPP and 2) the fixed costs of satisfying regulatory requirements. The time to market and the costs of clinical trials are assumed to increase with the level of regulatory stringency.

IV. Results

Most Likely Candidates for FoPPs and Rationale for their Selection

1. Evaluation of Biologic Categories

As described in Section III: Methodology, each of the top 10 biologic categories according to 2006 annual sales was evaluated using a set of criteria (e.g., regulatory route, market factors) to determine which categories are most likely to include candidates for FoPPs over the next decade. Information gathered during this review is presented by biologic category in Appendix B and summarized in Table 1.

Based on the factors listed for each category, in addition to feedback from expert stakeholders, two categories (i.e., recombinant coagulation factors and enzyme replacement biologics) were eliminated from consideration. Also, this analysis focuses on biologics currently under the PHS Act that would be eligible for a new abbreviated pathway with the passage of proposed legislation; therefore, the regulatory route for the biologic category was a key consideration. Given that hGH and insulin were approved under the FDCA rather than via the BLA pathway under the PHS Act, these two categories were also eliminated from further consideration.

2. Evaluation of Specific Biologics within the Selected Biologic Categories

Starting with the six remaining categories (i.e., EPO, MAb, anti-TNF, interferon beta, G-CSF, and interferon alpha), we examined individual biologics within these categories that ranked in the top 20 biologics according to 2006 sales. Criteria for this review are described in Section III: Methodology. Detailed information gathered during this review is presented in Appendix C and summarized by biologic category following Table 1.

Originator product markets are assumed to be closed to entry until expiry of both the patent protection period and data exclusivity period (Table 4), with FoPP entry in prior years assumed to equal zero.

| Procrit/Epogen | Herceptin | Rituxan | Avastin | Enbrel | Remicade | Avonex | Rebif | Neupogen | Pegasys | |

|---|---|---|---|---|---|---|---|---|---|---|

| Year of Market Launch | 1990 | 1998 | 1997 | 2004 | 1998 | 1998 | 1996 | 2002 | 1991 | 2002 |

| Initial indication | Anemia | Breast Cancer | Non-Hodgkin's Lymphoma | Colorectal Cancer | Rheumatoid Arthritis | Crohn's Disease | Multiple Sclerosis | Multiple Sclerosis | Neutropenia | Hepatits C |

| Year of Effective Patent Expiry | 2013 | 2015 | 2015 | 2017 | 2012 | 2014 | 2013 | 2013 | 2013 | 2017 |

| Procrit/ Epogen | Herceptin | Rituxan | Avastin | Enbrel | Remicade | Avonex | Rebif | Neupogen | Pegasys | |

|---|---|---|---|---|---|---|---|---|---|---|

| Data Exclusivity Period | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 | 12 |

| Year of Data Exclusivity Expiry | 2002 | 2010 | 2009 | 2016 | 2010 | 2010 | 2008 | 2014 | 2003 | 2014 |

⇓

| Procrit/ Epogen | Herceptin | Rituxan | Avastin | Enbrel | Remicade | Avonex | Rebif | Neupogen | Pegasys | |

|---|---|---|---|---|---|---|---|---|---|---|

| Market first open to FoPP entry | 2013 | 2015 | 2015 | 2017 | 2012 | 2014 | 2013 | 2014 | 2013 | 2017 |

Our approach draws from and adapts experience gained from the small molecule market. Following the opening of the market to competition, the initial number of FoPP entrants is estimated using Equation 1; derived following Grabowski et al. (2007) and Anderson, Palma and Thisse (1992). The starting point is the entry equation described by Grabowski et al. (2007), which is then adjusted to account for the need for the entry elasticity for FoPPs to reflect that FoPPs are likely to be more differentiated than small-molecule generics and that price-cost margins for biologic drugs are likely to differ from those of small-molecule drugs. In addition, the functional form of the entry equation is changed to prevent the prediction of negative entrants. The derivation of Equation 1 is detailed in Appendix A, Memo on Entry Modeling.

The estimation of the number of FoPP entrants proceeds in two steps. First, we estimate the number of generic entrants expected to enter a standard small molecule market equivalent in size to the biologic market of interest as measured by market revenue (the first term on the RHS of Equation 1). This number is then adjusted for differences between the markets for biologic drugs and small molecules, particularly higher price-cost margins and higher fixed costs of entry.

Equation 1

NFoPP = NSM (PCMFoPP / PCMSM * FCFoPP / FCSM)η

Where:

Description

Outcome:

NFoPP number of FoPP entrants into biologic market in first year market open

Inputs:

NSM number of entrants into small molecule market of equivalent size (in revenue)

PCMFoPP / PCMSM relative price-cost margin for FoPP drug versus originator biologic

FCFoPP / FCSM relative fixed costs of entry for FoPP

η elasticity of market entry w.r.t. fixed costs of entry, price-cost margins, and market revenue

Parameter Inputs:

NSM : number of entrants into small molecule market of equivalent size (in revenue)

estimation based on first stage equation from Grabowski (2007) study predicting number of entrants

into equivalent small molecule market:Equation 2

NSM = exp [0.07 + (0.36) *1n (MktSze) ]

MktSze : Projected US market in year in which market opens to entry (YOFE), measured by revenue in US$2000 (Table F-5).

- 2007 US market revenue from company annual reports

- Predicted growth in US market revenue from market research

- Projections of average growth in market revenue (sales) over period 2007-2012

Market Revenue of Branded Drug (US$mn) Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Mkt Revenue (US$mn) , 2007 $4,179 $1,506 $2,787 $2,695 $3,052 $2,534 $1,090 $625 $861 $388 Avg. YOY Change in Rev. 0.5% 5.0% 9.0% 19.0% 10.0% 8.0% 6.6% 18.0% 1.7% -7.0% Avg. YOY Change in Price -1.3% 3.7% 4.8% 0.2% 4.7% 1.3% 10.9% 10.9% 3.6% -3.5% Avg. YOY Change in Util. 1.8% 1.3% 4.0% 18.7% 5.1% 6.6% -3.9% 6.4% -1.8% -3.6% YOY=year on year (annual change)

Projected Mkt Revenue , 2009 $4,221 $1,660 $3,311 $3,816 $3,693 $2,956 $1,239 $870 $891 $336 Projected Mkt Revenue in YOFE $4,306 $2,225 $5,553 $15,347 $4,915 $4,343 $1,599 $1,991 $953 $188 PCMFoPP/ PCMSM : Relative price-cost margin (average mark-up) estimated from:

percentage gross margisn = (sales — cost of sales)/salesDefault value of 1.13 from:

- PCMFoPP = 0.87 from representative major biologic manufacturer

Table 2. Calibrations of Relative Fixed Costs of Entry between Biologic and Small-Molecule Markets

Pair of Calibrated Relative FC valuesProcrit/Epogen Neupogen Scenario 1: EU Market >8 >6.5 Scenario 2: Global Market >12.3 >10.8 Mid-Point >10.2 >8.7 As the relevant entry decision probably lies somewhere between these two hypothesized extremes, we use

the mid-point of the range in FC estimates (10.2 for EPOs, and 8.7 for Neupogen) in base-case analyses.

These analyses are subject to extensive sensitivity analyses which are discussed in Section 6.1.2.Estimates of the relative FC of entry parameter for the remaining biologic product markets are calculated,

relative to the EPO value of 10.2, by linking differences in the complexity of molecule structure to likely

differences in regulatory requirements for clinical evidence (Table F-6). These are based in part on the following

EMEA guidance and estimates of the cost of clinical trials in this population of $25,000 per patient, as follows:

- For somatropins: one "adequately powered, randomised, parallel group clinical trial"; 12-months immunogenicity data

Clinical Requirement Number of Patients Approximate cost Low 150 $3.75mn Medium 300 $7.5mn High 600 $15mn Very High 900 $22.5mn Erythropoietins are regarded as having "medium" regulatory requirements. These differences in expected clinical trial costs

are combined with an estimate of the cost of entering the small-molecule market of $2.5mn to estimate the relative FC of

entry for products with a Low, High and V. High regulatory requirement. The resulting estimates of relative FC range

between 8.7 and 16.2 (Table F-7).

Table F-6: Categories of Likely Regulatory Clinical Requirements

Clinical trial costs 1= Low 2= Medium 3= High 4= V. High

Clinical Trial Costs Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 1=Low

2=Medium

3=High

4=V. High2 4 4 4 3 4 1 1 1 3

Table F-7: Base-case Estimate of Relative Ratio of Fixed Cost of Entry for Follow-on Producers into Biologic versus Small Molecule Market[138]

Estimated relative fixed costs of market entry Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Relative FC of entry:

Biologic/Small Mol.10.20 16.20 16.20 16.20 13.20 16.20 8.70 8.70 8.70 13.20 Parameter Inputs:

η : Elasticity of entry for biologic market w.r.t. innovator market size, innovator PCM, and innovator FC (see Appendix A):

Equation 3

η = 1/1+ γ + δ ≈ 0.79

Where:

γ: entry elasticity of PCM

δ: entry elasticity of revenue

γ : Entry elasticity of PCM; calculated as:

γ = entry elasticity of price * price elasticity of PCM

γ = {0.36} * {(1-0.87)/0.87} = 0.054

- In Grabowski (2007), entry elasticity of price is ~0.72; we discount this by half to account for greater differentiation in FoPP market, i.e., to 0.36

- Price elasticity of PCM = (1-PCM)/(PCM); PCM in biologic market assumed to be 0.87; based on financial reports of pharmaceutical companies that specialize in biologic

δ : entry elasticity of revenue; calculated as:

δ =the entry elasticity of price * the price elasticity of revenue

δ = 0.36 * 0.6 = 0.216

- Entry elasticity of price assumed to be 0.36

- Price elasticity of revenue = 1 — price elasticity of demand; from literature, price elasticity of demand assumed to be 0.4Under these assumptions, our estimates of initial FoPP entrants range between 0 and 2 entrants for the markets under consideration (Table F-8). The model predicts zero entrants for Pegasys®, primarily because this market is forecast to decline in size. Currently, only one entrant is estimated for Herceptin® as well, although the key factor here is the complexity of the molecule and correspondingly high fixed cost of entry. In contrast, the model predicts two entrants into each of the interferon alpha markets, which is one more than the EU experience of a single application for FOPP entry into the interferon market; this was Alpheon (BioPartners), which referenced Roche's Roferon-A, which subsequently received a negative opinion from the Committee on Medicinal Products for Human Use.

Table F-8: Base-case Estimate of Number of FoPP Entrants

Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Year of first entry (YOFE) 2013 2015 2015 2017 2012 2014 2013 2014 2013 2017 Market rev. ($mn), YOFE $4,306 $2,225 $5,553 $15,347 $4,915 $4,343 $1,599 $1,991 $953 $188 Relative Fixed Costs of Entry 10.20 16.20 16.20 16.20 13.20 16.20 8.70 8.70 8.70 13.20 Elasticity of market entry 0.79 0.79 0.79 0.79 0.79 0.79 0.79 0.79 0.79 0.79

Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Predicted # entrants, YOFE 3 1 2 3 2 2 2 2 2 0 b. 2 Base-case Estimates Brand and FoPP Prices, Pre- and Post- FoPP Entry

Price calculations are based on defined daily doses as described in Figure 9. Base-case estimates of price discounts are a function of the estimated number of FoPP entrants and range between 12% and 20% for the markets with a positive number

Table F-9: Defined Daily Doses

Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 1000 units 20.8mg 71.4mg 25mg 7mg 3.75mg 4.3mcg 4.3mcg 0.35mg 26 mcg 'World without' Parameter Inputs

PbrandWWO : Price of the branded drug/daily dose in absence of FoPP entrants (Table F-10)

- Derived from average sales price (ASP) data reported by CMS in the January 2008 "Payment Allowance Limits for Medicare Part B Drugs" series.

- Prices for public payers set to ASP+6%, consistent with Medicare payment allowances

- Prices for private payers set to ASP

InflbrandWWO : Inflation rate of the branded drug/ daily dose in absence of FoPP entrants (Table F-10)

- Estimate based on 3-year CAGR from ASP+6% reimbursement data published by CMS in the January 2008 "Payment Allowance Limits for Medicare Part B Drugs" series.

- Inflation rate assumed to remain constant over duration of the mode

Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 1000 units 20.8mg 71.4mg 7mg 3.75mg 4.3mcg 4.3mcg 0.35mg 26 mcg

Brand Price ($/daily dose) Prior to FoPP Entry Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Brand price inflation -1.29% 3.66% 4.79% 0.22% 4.66% 1.31% 10.92% 10.92% 3.61% -3.50% 2007 ($/DDs) - ASP $ 8.45 $ 115.81 $ 342.76 $ 135.52 $ 44.58 $ 19.53 $ 45.10 $ 45.10 $ 210.08 $ 58.39 2009 ($/DDs) - ASP $ 8.24 $ 124.44 $ 376.41 $ 136.13 $ 48.83 $ 20.04 $ 55.49 $ 55.49 $ 225.52 $ 54.37 2019 ($/DDs) - ASP $ 7.23 $ 178.23 $ 601.16 $ 139.21 $ 77.04 $ 22.83 $ 156.38 $ 156.38 $ 321.57 $ 38.08 'World with' Parameter Inputs

InflbrandWW : Inflation rate of the branded drug/daily dose in presence of FoPP entrants (Table F-11)

- Brand price assumed to continue to rise after FoPP entry, albeit at a slower rate

- InflbrandWW = 0.95 * InflbrandWWO; based on Bhattacharya and Vogt (2003)

- The rate of brand price inflation changes post-FoPP entry is not dependent on the number of FoPP competitor

Table F-11: Price of Brand Drug, in Presence of FoPP entrants Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Brand inflation rate beforeFoPP entry -1.29% 3.66% 4.79% 0.22% 4.66% 1.31% 10.92% 10.92% 3.61% -3.50% Brand inflation rate after FoPP entry -1.36% 3.47% 4.55% 0.21% 4.43% 1.25% 10.37% 10.37% 3.43% -3.68% PFoPPWW: Discount associated with price of the FoPP/daily dose (Table F-12)

- Estimated as discount on PbrandWWO

- FoPP discount based on estimates from Reiffen and Ward (RW), 2005

Table 4: Estimates of FoPP

Based on estimates from Reiffen and Ward (2005)No.

FoPP entrantsRW estimates of generic discount

1 12% 2 19% 3 20% 4 22% 5 24% 6 26% 7 28% 8 28% 9 28% 10 31% 11+ 37%

Table F-12: Base-case Discounts Associated with FoPP Entry

FoPP Price Discount (%)Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2010 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2011 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2012 0% 0% 0% 0% 19% 0% 0% 0% 0% 0% 2013 20% 0% 0% 0% 19% 0% 19% 0% 19% 0% 2014 20% 0% 0% 0% 19% 19% 19% 19% 19% 0% 2015 20% 12% 19% 0% 19% 19% 19% 19% 19% 0% 2016 20% 12% 19% 0% 19% 19% 19% 19% 19% 0% 2017 20% 12% 19% 20% 19% 19% 19% 19% 19% 0% 2018 20% 12% 19% 20% 19% 19% 19% 19% 19% 0% 2019 20% 12% 19% 20% 19% 19% 19% 19% 19% 0% c. Base-case Estimates of Market Shares for FoPP Drugs

By definition, market shares of FoPP entrants prior to entry are zero. Base-case estimates of the cumulative market share for FoPP products in each market after entry range from 10% to 54% (Table F-13). Estimates are based on the OLS specification reported in Saha et al. (2005), and are a function of the FoPP price discount, number of FoPP entrants, market size, and level of HMO coverage (Table F-13):

Equation 4:

ln (MktShrFoPP/ MktShrbrand)= 0.998 - 2.4965 * (PriceFoPP/Pricebrand) + 0.705 * NFoPP

-0.0002 * MktSze - 0.3975 * BigMkt + 1.979 * HMOCovWhere:

MktShrFoPP/ MktShrbrand: Market share of FoPP entrants (cumulative) relative to the brand

PriceFoPP/Pricebrand: Ratio of FoPP price to brand price

NFoPP: Number of FoPP entrants

MktSze: Market size in year that market opens to entry (US$2000)

HMOCov: Average HMO share of payers; estimated as 21% of private payers and 12% of public payers

Table F-13: Base-case Estimates of FoPP Market Share

US market shares of FoPPs (%)Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2010 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2011 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 2012 0% 0% 0% 0% 28% 0% 0% 0% 0% 0 2013 35% 0% 0% 0% 28% 0% 48% 0% 54% 0% 2014 35% 0% 0% 0% 28% 32% 48% 45% 54% 0% 2015 35% 32% 27% 0% 28% 32% 48% 45% 54% 0% 2016 35% 32% 27% 0% 28% 32% 48% 45% 54% 0% 2017 35% 32% 27% 10% 28% 32% 48% 45% 54% 0% 2018 35% 32% 27% 10% 28% 32% 48% 45% 54% 0% 2019 35% 32% 27% 10% 28% 32% 48% 45% 54% 0% 2. Base-case Estimates of Overall Market Size, Pre- and Post- FoPP Entry

Market size in this model is defined in millions of daily doses (Table F-14). Initial market size is estimated by dividing 2009 market revenue by the estimated 2009 Pricewght /daily dose. The default estimate of Pricewght is the weighted price across private and public payers, derived from an analysis of commercial versus Medicare and Medicaid expenditures (Table F-15).

Table F-14: Initial Market Size (millions daily doses)

Daily Doses (DDs) DefinedProcrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 1000 units 20.8mg 71.4mg 25mg 7mg 3.75mg 4.3mcg 4.3mcg 0.35mg 26 mcg

Total market size (mn DDs) - US markets without FoPPsProcrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 Market Size 498.18 13.02 8.51 26.97 73.98 144.26 21.74 15.27 3.85 6.00 Avg. YOY Change in Util. 1.8% 1.3% 4.0% 18.7% 5.1% 6.6% -3.9% 6.4% -1.8% -3.6% a. 'World without' Parameter Inputs

Base-case estimates of increases in overall market size are calculated as the residual after projected changes in price are subtracted from projected changes in overall market revenue (Table F-16). Base-case estimates of market size do not account for entry of second-generation drugs.

Table F-16: Base-case Estimate of Market Size in Absence of FoPP Entry Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 1000 units 20.8mg 71.4mg 25mg 7mg 3.75mg/P 4.3mcg 4.3mcg 0.35mg 26 mcg/P

Total market size (mn DDs) - US markets without FoPPsProcrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 Market Size 498.18 13.02 8.51 26.97 73.98 144.26 21.74 15.27 3.85 6.00 Avg. YOY Change in Util. 1.8% 1.3% 4.0% 18.7% 5.1% 6.6% -3.9% 6.4% -1.8% -3.6%

Total market size (mn DDs) -US markets without FoPPsProcrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 498.18 13.02 8.51 26.97 73.98 144.26 21.74 15.27 3.85 6.00 2010 507.23 13.19 8.85 32.02 77.75 153.78 20.89 16.25 3.78 5.78 2011 516.45 13.36 9.2 38.02 81.72 163.94 20.08 17.28 3.71 5.57 2012 525.84 13.53 9.57 45.14 85.88 174.76 19.29 18.39 3.64 5.37 2013 535.39 13.71 9.96 53.6 90.26 186.3 18.54 19.56 3.58 5.18 2014 545.12 13.89 10.36 63.64 94.86 198.6 17.82 20.81 3.51 4.99 2015 555.03 14.07 10.77 75.56 99.7 211.72 17.13 22.14 3.45 4.81 2016 565.12 14.25 11.2 89.71 104.78 225.7 16.46 23.55 3.38 4.63 2017 575.39 14.43 11.65 106.52 110.12 240.6 15.82 25.06 3.32 4.46 2018 585.84 14.62 12.12 126.47 115.73 256.48 15.21 26.66 3.26 4.30 2019 596.49 14.81 12.61 150.17 121.63 273.42 14.61 28.36 3.20 4.15 b. 4.2 'World with' Parameter Inputs

The model assumes that any price discounts associated with FoPP entry will bring about an increase in the overall market size due to a positive elasticity of price demand, following Equation 5. Our base-case estimates of induced demand range between 1% and 3% of overall market size.

Equation 5:

InducedDemand = λ * EffectDisc

Where:

λ: Price elasticity of demand; base-case estimate is -0.4

- Estimate based on the mid-point of the range (-0.2 , -0.6) reported in the Goldman et al. (2007) review

Table F-17: Base-case Overall Price Discount in Market in "World With FoPPs"

Weighted Price Discount in MarketYEARS Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 2010 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 2011 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0% 2012 0.0% 0.0% 0.0% 0.0% 5.4% 0.0% 0.0% 0.0% 0.0% 0.0% 2013 7.1% 0.0% 0.0% 0.0% 5.6% 0.0% 9.2% 0.0% 10.2% 0.0% 2014 7.1% 0.0% 0.0% 0.0% 5.7% 6.1% 9.5% 8.8% 10.3% 0.0% 2015 7.2% 4.0% 5.2% 0.0% 5.9% 6.2% 9.7% 9.0% 10.4% 0.0% 2016 7.2% 4.1% 5.4% 0.0% 6.1% 6.2% 10.0% 9.3% 10.4% 0.0% 2017 7.3% 4.2% 5.6% 2.1% 6.2% 6.2% 10.2% 9.6% 10.5% 0.0% 2018 7.3% 4.3% 5.7% 2.1% 6.4% 6.3% 10.5% 9.8% 10.6% 0.0% 2019 7.3% 4.4% 5.9% 2.1% 6.5% 6.3% 10.7% 10.1% 10.7% 0.0% Base-case estimates of overall market size in the presence of FoPP entry are presented in Table F-18. It is assumed that both brand and FoPP manufacturers will actively support their drugs with advertising and detailing. The implication of this assumption is that FoPP entry does not exert a negative effect on overall market size, as is sometimes the case in the small molecule market.

Table F-18: Base-case Estimates of Market Size in Presence of FoPP Entrants

Inputs for Estimation of Market Size Following FoPP EntryProcrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys YOFE 2013 2015 2015 2017 2012 2014 2013 2014 2013 2017 FoPP % price discount, YOFE 20% 12% 19% 20% 19% 19% 19% 19% 19% 0% FoPP market share, YOFE 35% 32% 27% 10% 28% 32% 48% 45% 54% 0% Price elasticity of demand -0.4 -0.4 -0.4 -0.4 -0.4 -0.4 -0.4 -0.4 -0.4 -0.4 ↓

Market size (mn DDs) - US markets with FoPP entry YEARS Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 498.18 13.02 8.51 26.97 73.98 144.26 21.74 15.27 3.85 6.00 2010 507.23 13.19 8.85 32.02 77.75 153.78 20.89 16.25 3.78 5.78 2011 516.45 13.36 9.20 38.02 81.72 163.94 20.08 17.28 3.71 5.57 2012 525.84 13.53 9.57 45.14 87.74 174.76 19.29 18.39 3.64 5.37 2013 550.57 13.71 9.96 53.60 92.27 186.30 19.23 19.56 3.72 5.18 2014 560.67 13.89 10.36 63.64 97.04 203.46 18.50 21.54 3.66 4.99 2015 570.95 14.29 11.00 75.56 102.05 216.93 17.80 22.94 3.59 4.81 2016 581.42 14.48 11.45 89.71 107.32 231.30 17.12 24.43 3.52 4.63 2017 592.09 14.68 11.91 107.41 112.86 246.61 16.47 26.02 3.46 4.46 2018 602.95 14.87 12.40 127.54 118.68 262.94 15.84 27.71 3.40 4.30 2019 614.01 15.07 12.91 151.43 124.81 280.35 15.24 29.51 3.34 4.15 3. Base-case Estimates of Cost-Impact

Under our default assumptions, the base-case scenario estimates cost savings from entry of FoPPs totaling approximately $10 billion dollars (Table F-19). Using the estimated distribution of private and public payers reproduced in Table F-20, $5.3 billion of this amount is estimated to accrue to private payers (not shown) and $4.6 billion is estimated to accrue to public payers (Table F-21).

Table F-19: Estimated Cost Impact of Availability of FoPPs: All Payers, 2009-2019

US Market without FoPPs

Total Cost of Originator Drug ($mn), 2009-2019 Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost ($mn) $47,608 $23,588 $58,146 $116,032 $68,434 $49,198 $19,141 $25,024 $10,672 $2,636 US Market with FoPPs

Total Cost of Originator Drug ($mn), 2009-2019 Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost ($mn) $37,350 $19,736 $49,574 $110,690 $53,247 $39,396 $12,754 $16,699 $7,003 $2,636

Total Cost of FoPP drugs ($mn), 2009-2019Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost ($mn) $8,847 $3,513 $7,364 $4,634 $12,919 $8,541 $5,392 $7,037 $3,175 $0 Cost Impact of FoPPs

Cost of Drug ($mn) Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost - US Markets $47,608 $23,588 $58,146 $116,032 $68,434 $49,198 $19,141 $25,024 $10,672 $2,636 Total Cost - US Markets $46,197 $23,249 $56,938 $115,324 $66,166 $47,937 $18,147 $23,736 $10,179 $2,636 Cost Impact of FOPPs $1,412 $340 $1,208 $707 $2,268 $1,262 $994 $1,288 $493 $0 Total Cost Impact (in US$ millions) $9,972

All Payers: Cost Impact of FOPPs ($mn) - by year YEARS Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2010 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2011 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2012 $0 $0 $0 $0 $168 $0 $0 $0 $0 $0 2013 $193 $0 $0 $0 $193 $0 $97 $0 $63 $0 2014 $196 $0 $0 $0 $222 $167 $110 $115 $65 $0 2015 $199 $56 $183 $0 $254 $182 $124 $144 $68 $0 2016 $202 $61 $209 $0 $290 $199 $139 $180 $70 $0 2017 $205 $67 $238 $195 $332 $217 $156 $224 $73 $0 2018 $208 $74 $271 $233 $378 $237 $174 $279 $76 $0 2019 $211 $81 $308 $279 $431 $259 $194 $346 $78 $0

Table F-20: Ratio of Public to Private Payers for Selected Biologic Drugs

Distribution of Public and Private PayersProcrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Public Payers 48% 41% 57% 66% 37% 37% 45% 45% 41% 48% Private Payers 52% 59% 43% 34% 63% 63% 55% 55% 59% 52% Public+private 100% 100% 100% 100% 100% 100% 100% 100% 100% 100% Table F-21: Estimated Cost Impact of Availability of FoPPs: Public Payers, 2009-2019

Coverage of Expenditures by Public Payers, 2009-2019 Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Public Payer Coverage 48% 41% 57% 66% 37% 37% 45% 45% 41% 48% US Market without FoPPs

Total Cost of Originator Drug ($mn), 2009-2019 Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost ($mn) $23,545 $10,005 $33,970 $78,084 $26,257 $18,877 $8,890 $11,623 $4,527 $1,304 US Market with FoPPs

Total Cost of Originator Drug ($mn), 2009-2019 Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost ($mn) $18,471 $8,371 $28,962 $74,489 $20,430 $15,115 $5,924 $7,756 $2,971 $1,304

Total Cost of FoPP drugs ($mn), 2009-2019 Procrit/Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost ($mn) $4,375 $1,490 $4,302 $3,119 $4,957 $3,277 $2,505 $3,268 $1,347 $0 Cost Impact of FoPPs

Cost of Drug ($mn) Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys Total Cost - US

Markets$23,545 $10,005 $33,970 $78,084 $26,257 $18,877 $8,890 $11,623 $4,527 $1,304 Total Cost - US

Markets$22,847 $9,861 $33,264 $77,608 $25,387 $18,392 $8,428 $11,024 $4,318 $1,304 Cost Impact of

FOPPs$698 $144 $706 $476 $870 $484 $462 $598 $209 $0 Total Cost Impact (in US$ millions) $4,648

Public Payers: Cost impact of FOPPs ($mn) - by year Procrit/ Epogen Herceptin Rituxan Avastin Enbrel Remicade Avonex Rebif Neupogen Pegasys 2009 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2010 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2011 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 2012 $0 $0 $0 $0 $64 $0 $0 $0 $0 $0 2013 $95 $0 $0 $0 $74 $0 $45 $0 $27 $0 2014 $97 $0 $0 $0 $85 $64 $51 $53 $28 $0 2015 $98 $24 $107 $0 $97 $70 $57 $67 $29 $0 2016 $100 $26 $122 $0 $111 $76 $65 $84 $30 $0 2017 $101 $29 $139 $131 $127 $83 $72 $104 $31 $0 2018 $103 $31 $158 $157 $145 $91 $81 $130 $32 $0 2019 $104 $34 $180 $188 $165 $100 $90 $161 $33 $0 6. Sensitivity Analyses

6.1 Effect of Differences in Regulatory Requirements

Given the uncertainty regarding new approval pathways for FoPPs, it is important to develop estimates of the cost impact of the availability of FoPPs that account for the effects of proposed approval pathways that have differing levels of stringency. In this model, differences in the stringency of the approval process influence estimated cost impacts through two main parameters: 1) the time to market entry of the FoPP and 2) the fixed costs of satisfying regulatory requirements. Both of these parameters are assumed to increase with the level of regulatory stringency. Regulatory stringency affects the time to market entry of FoPPs in multiple ways. Principally, the greater the level of clinical evidence required, the more time required to comply with the requirements. Also, waiting for clarifying guidance to be issued by regulatory bodies can delay FoPP entrance. We explore the effects of varying the time to initial FoPP entrance and varying fixed costs of entry below.

6.1.1 Timing of Initial Entry of FoPP Competitors

The base-case analysis assumes that the market opens to FoPP competition once the listed patent protection period expires and the data exclusivity period lapses. However, the market may open to FoPP competition more quickly or more slowly than our base-case estimates. Regulators may call for greater or lesser levels of clinical evidence to be provided in support of approval processes. Potential applicants could be required to delay pursuing market access pending issuance of formal guidance. A final legislated data exclusivity period for protein products may differ from our base-case estimate of 12 years. Entry may occur more rapidly if there is a successful challenge to the patent (outside of a countervailing data exclusivity period). Finally, FoPP competition may be stalled if the first indication to open to competition is not sufficiently attractive. Thus, we explored the effect of varying the date at which the FoPP market is open to entry on our estimates of cost impact.

As is evident in Table 5, delaying projected initial entry of FoPP competitors by five years reduces our estimate of cost savings from FoPP availability by $7.9 billion, or 79%.

Table 5: Effect on Varying Time of FoPP Entry on Estimates of

Cost-Impact of FoPP Availability ($billion)Earliest Entry Latest Entry Cost Impact All Payers

2009-2019Cost Impact Private Payers

2009-2019Cost Impact Public Payers

2009-20195 years earlier 2009 2014 $17.56 $9.00 $8.56 2 years earlier 2010 2015 $13.40 $7.07 $6.33 Base case 2012 2017 $9.97 $5.32 $4.65 2 years later 2014 2019* $6.53 $3.57 $2.96 5 years later 2017 2019* $2.08 $1.20 $0.88 Five years earlier is set to 2009 as it would be unrealistic to estimate the cost impact in 2007 when there were no FoPPs.

Some markets do not open to entry during model duration.6.1.2 Variation in Fixed Costs of Entry

Our base-case analysis assumes that regulatory requirements for FoPP entrants will resemble those issued thus far by the EMEA. Thus, we classify the likely requirements for Neupogen® and the interferon betas (Avonex® and Rebif®) as "low" (150-patient trial) and the likely requirements for the EPOs as "medium" (300-patient trial). However, it may be the case that regulatory requirements are more stringent. In Table 6, we explore the effect of increasing the clinical requirements by progressively raising the minimum level of evidence required.

In the context of our model, raising the minimum requirement for clinical evidence from low to medium has a minimal effect on our base-case estimates. Requiring all entrants to meet a "very high" standard of clinical evidence has a relatively small effect on our baseline estimates of cost savings, reducing the estimate by $1.5 billion, or 15.3%.

Table 6: Effect of Increasing Clinical Requirements on Estimates of

Cost-Impact of FoPP Availability ($billions)Cost Impact All Payers

2009-2019Cost Impact Private Payers

2009-2019Cost Impact Public Payers

2009-2019Base case $9.97 $5.32 $4.65 Minimum clinical requirement> Medium: 300 pts>

$9.71> $5.18> $4.54> Minimum clinical requirement> High: 600 pts>

$8.45> $4.50> $3.94> Minimum clinical requirement> Very High: 900 pts>

$8.45> $4.50> $3.94> Our base-case estimates of the ratio of fixed costs of entry for a biologic versus small molecule market (ratios of 8.7-16.2) are calibrated to produce an estimate of FoPP entrants in the EPO market that has face validity. However, these are significantly lower than, for example, the values implied by Grabowski et al. (2007), which range as high as 100. These latter ratios would be expected if, for example, every potential entrant would require building an entirely new facility to enter the biologic market, but could rely on existing production capacity to enter the small molecule market. In Table 7, we explore the effect of varying our estimate of the ratio of fixed costs of entry for a biologic versus small molecule market (FCFoPP/ FCSM) directly. In the context of our model, as one would expect, the number of FoPP entrants is sensitive to the ratio FCFoPP/ FCSM. A ratio of 25 decreases estimated cost savings by $5 billion, or 46.9%. A ratio of 50 results in a single FoPP entrant for Avastin® and negligible cost savings. To put these figures in context, if we assume that fixed costs of entry in the small molecule generic market average $2.5 million, FCFoPP/ FCSM ratios of 25 and 50 imply FoPP fixed costs of entry of $62.5 million and $125 million respectively.

Table 7: Effect of Varying Fixed Costs of Entry for Biologic Market

versus

Small Molecule Market on Estimates of Cost-Impact of FoPP Availability ($billions)Maximum No. FoPP Entrants Cost Impact All Payers 2009-2019 Cost Impact Private Payers 2009-2019 Cost Impact Public Payers 2009-2019 Base case 3 $9.97 $5.32 $4.65 2 $5.30 $2.78 $2.51 1 $0.30 $0.10 $0.20 0 $0.00 $0.00 $0.00 6.2 Multi-year Entry of FoPPs

Our approach is based, in part, on Grabowski et al. (2007), who model the specific question "What is the equilibrium number of generic entrants in the twelve-month period after the market opens to competition (i.e., after patent expiry, and the expiry of the data exclusivity agreement)?" Similarly, our base case estimates assume that that the number of FoPP entrants in place 12 months after the market opens to competition will remain constant for the remainder of the study period.

It may be the case (as occurs in small molecule markets) that additional FoPP products would enter the market in subsequent years. Therefore, we explore the effect of allowing additional FoPP entrants after the first year in which the market opens (for products that experience a positive number of entrants). Additional entrants would enter in the second year of market opening and would, in the context of the model, exert downward pressure on the relative FoPP price, increase the FoPP market share, and increase the estimated cost savings associated with FoPP entry as shown in Table 8. Assuming even a single additional entrant in each market in the subsequent year increases our estimate of cost savings by $2.3 billion, or 22.8%.

Table 8: Effect of Allowing Additional FoPP Entry on Estimates of

Cost-Impact of FoPP Availability ($billions)Largest Discount Largest Market Share Cost Impact All Payers

2009-2019Cost Impact Private Payers

2009-2019Cost Impact Public Payers

2009-2019Base case 20% 54% $9.97 $5.32 $4.65 22% 63% $12.25 $6.56 $5.69 24% 78% $16.54 $8.91 $7.63 6.3 Interchangeability of FoPPs

The microeconomic studies of pricing and market share in the pharmaceutical industry referenced here share the assumption of homogenous generic entrants. Given the anticipated differences in the production processes, FoPPs are likely to be inherently heterogeneous. While modeling FoPP heterogeneity directly is beyond the scope of this analysis, we can probe the effects of the likely outcome of such heterogeneity. A market in which there were heterogeneous FoPP entrants would behave in a manner more characteristic of an oligopoly or imperfectly competitive market, i.e., with higher prices (smaller discounts) and smaller quantities sold, although the effects on the relative market shares of brands and FoPPs are ambiguous.

To examine the potential effects of greater heterogeneity among FoPP entrants, we re-estimate the model with smaller discounts associated with FoPP entry and assess the effect on estimates of cost impact. As shown in Table 9, decreasing the price discount that would accompany FoPP entry, as would be expected for a small number of heterogeneous products, has a fairly significant effect on our estimates of overall cost impact. A 25% reduction in the estimated FoPP discount decreases estimated cost savings by $3.2 billion, or 32%.

Table 9: Effect of Varying Estimated FoPP Price Discounts on Estimates of

Cost-Impact of FoPP Availability ($billions)Smallest* Discount Largest Discount Cost Impact All Payers

2009-2019Cost Impact Private Payers

2009-2019Cost Impact Public Payers

2009-2019Base case 12% 20% $9.97 $5.32 $4.65 9% 15% $6.78 $3.62 $3.15 7% 12% $5.26 $2.82 $2.44 *Smallest non-zero discount

6.4 Variation in FoPP Price & Market Share

There are a number of additional demand- and supply-side factors that are not modeled explicitly in our analysis that nonetheless might influence FoPP prices and FoPP market shares. Examples of such factors that might affect pricing include strategic pricing on the part of FoPP manufacturers and payers' ability to extract large price discounts. Factors that affect the demand for FoPP products include brand loyalty on the part of patients, perceived therapeutic substitutability, and the extent to which payers are able to influence physician prescribing behavior. Although modeling these factors explicitly is beyond the scope of this analysis, it is instructive to explore how variation in assumptions of FoPP price discounts and market uptake affect estimates of overall cost impact.

Previously, we explored the effect of more conservative estimates of FoPP price discounts that might be associated with a small number of heterogeneous FoPPs. Here, we explore the effect of more aggressive price discounts that would be consistent with strategic pricing behavior by FoPP manufacturers, or payers extracting large pricing concessions. In the context of the model, aggressive FoPP discounts would lead to larger FoPP market share as well as an increase in overall market size. (The model does not allow FoPP market share to rise above 85%). As Table 10 shows, more aggressive estimates of discounting behavior on the part of FoPP manufacturers has a dramatic effect on the estimate of overall cost impact. For example, assuming that all FoPPs discount heavily at 40% (a figure that is not inconsistent with the small molecule market) leads to an increase in the estimated cost impact of $35 billion.

Table 10: Effect of Increase in FoPP Discounts on Estimated Cost Impact of

Availability of FoPPs ($billions)Smallest* Discount

Largest Discount

Cost Impact All Payers

2009-2019Cost Impact Private Payers

2009-2019Cost Impact Public Payers

2009-2019Base case 12% 20% $9.97 $5.32 $4.65 25% 25% $16.15 $8.67 $7.48 40% 40% $44.20 $23.80 $20.40 *Smallest non-zero discount

Likewise, we might expect that market uptake of FoPPs would lag if patients exhibit high levels of brand loyalty, or physicians perceive the FoPPs to have low levels of therapeutic substitutability. Conversely, if payers are able to influence physician prescribing behavior or institute a tier-structure that promotes FoPP use, then market penetration might be considerably higher than our base-case estimates. Our estimates of cost impact are less sensitive to variation in market share versus variation in prices, in part because the effects of changes in price are compounded by reinforcing changes in market share. As shown in Table 11, a 25% increase in base-case FoPP market share only increases estimated cost-impact of FoPP availability by $2.3 billion, or 23%.

Table 11: Effect of Change in FoPP Market Share on Estimated Cost Impact of